Vietnam’s e-commerce landscape is witnessing remarkable growth. According to Google, it’s the second-fastest-growing e-commerce market in the world, trailing only behind Indonesia. The country’s e-commerce market is poised to reach a substantial US$15 billion by 2025, driven by increasing internet penetration, digital adoption, and changing consumer behavior. This surge in demand has led to a phenomenal 42% annual growth projection until 2022, underlining the country’s rapid embrace of online shopping.

The significance of e-commerce in Vietnam is further underscored by the e-commerce logistics sector. It plays a pivotal role in the country’s economy, contributing around 20-25% to the GDP, as highlighted by the Vietnam Logistics Business Association. With a consistent annual growth rate of about 12%, this sector has truly emerged as a thriving and lucrative industry.

Investors are drawn to the opportunities this sector presents, and success stories are becoming more common with each passing year. The specific focus on logistics services and express delivery tailored to the e-commerce sector has propelled this growth and led to substantial investment. This trend showcases the dynamic nature of Vietnam’s economy and its adaptation to the digital age.

Find Out About InCorp’s Incorporation Services in Vietnam for Foreign Firms

Characteristics of the E-commerce Logistics Vietnam Market

Rapid growth of e-commerce in Vietnam

The e-commerce landscape in Vietnam has experienced rapid growth, fueled by the digital revolution. The pandemic and subsequent lockdowns in 2020 alone witnessed a staggering 54% surge in e-commerce sales. In 2020, Vietnam achieved an impressive e-commerce sales volume of USD 11.8 billion, making it the only Southeast Asian country to record double-digit sales growth during the Covid-19 pandemic. This growth and resilience in the e-commerce sector position Vietnam as an attractive investment opportunity in the region. It is further projected that this growth will continue to exceed current sales shares, reaching new heights by 2028.

Read More: Doing Business in Vietnam as a Foreign Investor: What, Where, Why, How?

The implementation of remote work policies by companies following the pandemic has further propelled the growth of the e-commerce sector in Vietnam. This has resulted in the entry of new businesses and an increased demand for e-commerce delivery services. Cash-on-delivery transactions have been on the decline, while e-wallets and mobile payments have gained popularity, gradually replacing cash across various sectors of commerce. Additionally, the shift towards online transactions has also benefited online education platforms, which are expected to experience exponential growth.

The Vietnamese government has also placed significant emphasis on promoting the growth of the e-commerce market and has set ambitious goals for its development. The national plan for e-commerce development aims for 50% of local small and medium-sized enterprises (SMEs) to engage in digital business through domestic and global e-commerce platforms between 2021 and 2025.

In response to these initiatives, Vietnamese businesses are actively engaging in e-commerce activities to contribute to its development. Many Vietnamese suppliers have become high-star suppliers on platforms like Alibaba.com, with a wide range of industries represented, including Food & Beverages, Agriculture, House and Garden, Beauty and Personal Care, Furniture, Construction, Packaging, Plastics & Rubber, and Machinery.

The e-commerce market in Vietnam is experiencing rapid expansion, presenting entrepreneurs with new business opportunities. With an expected e-commerce user base of over 70% of the country’s population by 2025, the sector has garnered significant attention. The market has witnessed the release of more than 80,000 products, attracting over 70,000 inquiries from active buyers worldwide. This demonstrates the growing potential and appeal of Vietnam’s e-commerce market.

Read Related: Offering E-commerce Services by Establishing your FDI Company in Vietnam

Cross-border E-commerce Potential

The recent growth of e-commerce has presented a valuable chance for businesses to tap into the export market more easily. On June 21, 2023, a workshop was conducted in Ho Chi Minh City which highlighted the potential of cross-border e-commerce in Vietnam in the Association of Southeast Asian Nations (ASEAN).

The tremendous potential of e-commerce in Vietnam is also aligned with the government’s development policies on the digital economy. This emerging sector offers an effective complement to traditional international trade, leveraging technology to expand the reach of Vietnamese products to global customers.

An Analysis of E-commerce Logistics Vietnam Industry

Vietnam’s e-commerce logistics industry has gained recognition on a global scale, with the country’s logistics market securing the 11th position among the top 50 emerging markets. This accomplishment can be attributed to the widespread adoption of technology by both logistics service providers and their customers, as reported by Agility, a prominent supply chain service provider.

Introduction to E-Commerce Logistics Vietnam

When selling on popular e-commerce platforms in Vietnam such as Shopee, Lazada, Tiki, and Sendo, the shipping options will be seamlessly integrated into the system. Customers will typically have the choice to select their preferred shipping option during the order placement process. These e-commerce platforms often have their own logistics networks or collaborate with external shipping couriers.

There are two scenarios to consider:

- If your products are already in Vietnam, you will only need to pack the order. The shipping courier will handle the pickup and delivery of the package.

- If your products are located outside of Vietnam, you will need to pack and label the order and then ship it to the corresponding sorting hub or fulfillment center. It’s important to note that Sendo currently does not support international sellers, so you may need to explore other e-commerce platforms for selling your products in Vietnam.

Market Size and Key Players

The logistics report of 2017 by the Ministry of Industry and Trade states that Vietnam has around 50 companies that provide e-logistics services. Viettel Post, VN Post, and EMS are traditional postal service providers who have adapted to the market by offering solutions for online retailers. With an extensive post office network, panning the entire country and a sturdy operational capacity, they are particularly strong in rural areas.

In urban areas, there is a significant demand for convenient and express delivery services. This presents a suitable occasion for logistics start-ups to bring technology-driven solutions aimed at improving service quality and optimizing operations. In recent years, several delivery start-ups focused on e-commerce have entered the market, with some receiving substantial financial support from investors. Notable names in this sector include Giao Hang Nhanh (GHN), Giao Hang Tiet Kiem (GHTK), and NinjaVan, which are currently key delivery partners for major e-commerce platforms such as Lazada, Sendo, Shopee, etc., in Vietnam.

DHL, an international logistics service provider has also introduced the DHL Parcel Metro Same Day service. This provides real-time tracking and flexible delivery rescheduling through their custom digital platform.

The on-demand delivery segment, which focuses on immediate or scheduled deliveries, has experienced significant growth, particularly in the food delivery sector. This has attracted numerous players such as Delivery Now, Grab, GoViet, Ahamove, Lalamove, and various other smaller start-ups, contributing to the dynamic growth of the market.

ITL Corp’s Speedlink has recognized the potential of the express delivery market in Vietnam and has expanded its operations to cover 50 cities and provinces across the country. Indo Tran Logistics has also entered the express delivery service field, aiming to tap into the growing demand.

Giao Hang Nhanh is another prominent player in the e-commerce logistics and delivery sector, serving 800 online stores. Furthermore, 4PL (4th party) logistics providers have emerged in the market, offering customized solutions to customers who require greater flexibility in their shipping needs. Notable firms in this space include CBIP Logistics from Hong Kong and Kuehne + Nagel from Switzerland.

Ride-hailing leaders Grab and Uber have reaped substantial profits in Vietnam by addressing local logistics network gaps. Grab has expanded its services to include GrabExpress, a dedicated delivery service for documents, parcels, and gifts.

Trend Predictions for the E-commerce Logistics Industry in Vietnam

Investments in Infrastructure Development

Vietnam’s transportation system is set to undergo significant improvements and foster economic development with the implementation of the Master Plan for Transportation Development 2021-2030. This plan highlights various opportunities such as:

- The plan outlines the expansion of transportation infrastructure, including the construction and expansion of highways, seaports, and airports. These initiatives aim to improve connectivity within Vietnam and with neighboring countries, fostering efficient movement of goods and people.

- Another significant aspect of the plan is the development of high-speed railway networks, such as the North-South high-speed railway and the Ho Chi Minh City-Can Tho high-speed railway. These projects will facilitate faster and more convenient intercity travel, enhancing transportation efficiency and connectivity.

- To align with global sustainability efforts, the plan emphasizes the shift towards environmentally friendly transportation solutions. This includes promoting clean technologies and establishing robust public transportation systems in urban areas.

- The plan also encourages private sector participation by offering incentives and creating a favorable legal framework. Public-private partnerships (PPP) will be established to facilitate collaboration between the government and private investors.

Expansion of Last-mile Delivery Networks

The logistics industry is facing both opportunities and challenges due to the surge in online shopping, particularly in meeting the increasing demand for order fulfillment and last-mile delivery. The speed of delivery plays a crucial role in customer satisfaction and retention, giving an advantage to online shops that provide fast and reliable delivery of quality products.

Logistics firms have observed a growing need for the transportation of specific goods and cross-border express delivery, driven by new consumer trends and the booming e-commerce market. To adapt to these changes, delivery and shipping companies are adjusting their business models and strategies. This is in order to embrace digital transformation and launch specialized services, to cater to different customer segments. The aim is to enhance service quality, improve customer satisfaction, and meet evolving demands.

However, challenges persist in terms of traffic congestion, both within cities and on inter-provincial roads, affecting the delivery speed. For lack of an immediate solution to this issue, companies are finding ways to optimize order processing time. Last-mile delivery solutions being in high demand have spurred growth in the express delivery services industry.

Delivery firms partner with third parties, offering integrated solutions to help sellers enhance efficiency and meet customer expectations. For example, J&T Express collaborated with Pancake, Kiot Vie, Haravant, and Upos to allow sellers to track the entire shipping process. This approach ensures quality control and effective management of goods throughout the warehouse and the supply chain.

Express delivery businesses recognize that the competitive nature of the market presents both pressure and motivation for improvement. Companies are investing in transit centers and leveraging technology solutions to enhance their management and operations. By owning a network of modern transit centers and implementing technologies like the ‘Track and Trace‘ system, companies can ensure quick and accurate delivery to consumers. Mobile applications and websites further streamline the delivery process, making it easier, faster, and more efficient for all parties involved.

International Companies entering Vietnam

Maersk, a global shipping giant, and FedEx, an express delivery company based in the U.S., are actively exploring opportunities to enter Vietnam’s thriving e-commerce logistics market. Maersk, after its acquisition of the Hong Kong firm LF Logistics, believes that it can leverage itself in the global e-commerce market, particularly Vietnam, because of LF Logistics’ genius in handling omnichannel orders.

FedEx is making significant strides in Vietnam’s e-commerce logistics market by integrating its services with popular e-commerce platforms. This has allowed online retailers to seamlessly utilize FedEx services without having to leave the platforms. To support its operations in Vietnam, FedEx has recently invested US$2 million into a state-of-the-art operations center in Hanoi’s Bac Tu Liem District.

Vietnam is poised to become one of the top 10 countries for FedEx in terms of trade volume growth over the next five years. The country’s digital economy is projected to experience remarkable growth. A report by Google, Temasek, and Bain & Company suggests that Vietnam’s digital gross merchandise volume could reach US$23 billion in 2022 and US$32 billion by 2025.

The thriving e-commerce industry in Vietnam is a key driver for the growth of the express delivery market, which is forecasted to reach a value of US$4.88 billion by 2030, growing at an impressive annual rate of 24.1%. In response to this growing demand, logistics firms are expanding their service offerings and adopting competitive pricing strategies to capture a larger market. For instance, Lazada Logistics, a leading e-commerce logistics provider in Vietnam, recently announced its plans to offer omnichannel deliveries.

Integration of Technology and Automation

Recognizing the growing demand for efficient storage and order processing, companies like Lazada Logistics Vietnam are actively embracing digital transformation. With the aim of optimizing operations and reducing reliance on manual labor, Lazada Logistics is set to launch a sorting center that leverages technology and automation.

Tiki, an e-commerce platform, has implemented robots for sorting purposes since the end of 2021. Established delivery companies like DHL and Viettel Post are also following suit by embracing new technologies to streamline operations and reduce costs.

Developed countries have already made significant progress in using automation to reduce expenses. This not only significantly reduces labor costs but also shortens delivery time. If Vietnamese companies can successfully adopt automation in their logistics operations, the country has the potential to attract attention and investment from investors across Asia.

Focus on Sustainability and Green Logistics

With an increasing focus on sustainability and environmental consciousness, the concept of ‘green logistics’ has gained significant attention in Vietnam’s business landscape. Consumers’ growing interest in environmentally friendly products, coupled with the global trend toward green transition, has pushed companies to prioritize sustainable logistics practices.

Activities that protect the environment and slash negative effects, thereby attaining a sustainable equilibrium between socio-economic and environmental goals are defined as ‘green logistics’, as per a 2022 report on Vietnam’s logistics industry. The report also states that a notable 73.2% of the surveyed firms have incorporated green logistics into their business strategies.

Despite finances being a major barrier for Vietnamese companies looking to implement green logistics practices, it is an inevitable future trend. Embracing sustainability not only reflects positive corporate responsibility but also enhances firms’ competitiveness in the market. Global logistics groups are increasingly requesting their service providers to adhere to emissions standards.

To encourage green logistics adoption, firms should utilize government and organizational assistance and incentives. Authorities and agencies must enact laws, promote sustainability, and develop multimodal transport infrastructure for comprehensive progress.

Challenges to Consider for Foreign Investors

Despite the global economic volatility, Vietnam’s logistics industry is expected to thrive in the coming years. However, sustainable long-term growth also depends on the development of infrastructure in the country. Vietnam currently ranks 71st in terms of transport network, highlighting the limited extent and quality of infrastructure as key challenges for investors.

Overreliance on roads risks supply chain disruptions, raising business insurance costs. The government addresses challenges by approving a master plan to expand expressways from 1,290 to 5,000 kilometers by 2030. The construction of the Long Thanh International Airport and the north-south high-speed rail network is underway too.

However, many infrastructure projects have faced setbacks and budget overshoots. A significant impediment is the slow doling out of public funding, appropriated for infrastructure.

To overcome these challenges, public-private partnerships can be explored as an alternative to solely relying on public projects. Private players are also making significant investments to expand their capacity. Gemadept, a major ocean transporter, plans to triple Gemalink’s deep-water port capacity in its upcoming second-phase expansion.

Despite the promising e-commerce logistics sector in Vietnam, one of the major challenges faced by the sector is the need to accommodate cash-on-delivery (COD) services. This can result in both labor and operational costs. As e-commerce transactions surge, logistics providers must also manage a corresponding influx of damaged, exchanged, and returned goods.

Another challenge is the poor quality of addresses, which can lead to difficulties in locating and delivering packages accurately. Additionally, serving rural areas poses logistical challenges, due to limited infrastructure and connectivity.

Failed deliveries can result from factors like incorrect addresses, recipient unavailability, or difficulty in accessing certain locations. This poses a consequential hurdle. About 75% of e-commerce orders occur in and between Hanoi and Ho Chi Minh City, metropolitan cities with heavy traffic loads. This intensifies the competition among e-logistics players to provide fast and cost-effective delivery services.

Read More: Top 10 Challenges of Doing Business in Vietnam: Notes and Advice

E-commerce Logistics: The Future in Vietnam

Just like any market, e-commerce logistics in Vietnam have its own share of challenges as well. These challenges include higher operational costs due to the cash-based economy in Vietnam, and heavy traffic in cities such as Hanoi and Ho Chi Minh City. Also, last-mile delivery is more challenging in rural areas in Vietnam.

Despite the challenges, it is certain that the future of e-commerce logistics in Vietnam is highly positive. This is because the signing of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the European Union Free Trade Agreement (EVFTA) will bring more foreign investments into the country’s information and infrastructure system.

Read More: Guide to Vietnam’s 16 Active Free Trade Agreements (Updated August 2023)

Conclusion

The e-commerce logistics industry in Vietnam is experiencing significant growth and presents lucrative opportunities for businesses. Thriving e-commerce and consumer demand make logistics crucial for efficient order fulfillment and last-mile delivery.

Vietnam’s government and logistics firms are actively working to support the growth of the e-commerce logistics market. The government has set ambitious goals for digital business adoption among local small and medium-sized enterprises. Technology integration and automation are transforming the logistics landscape, improving operational efficiency and reducing costs. Additionally, the focus on sustainability and green logistics aligns with global trends and enhances corporate responsibility.

How InCorp Vietnam Can Help Your Business?

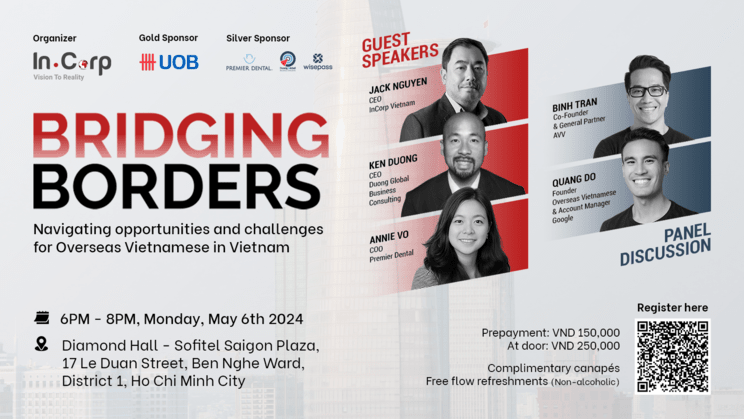

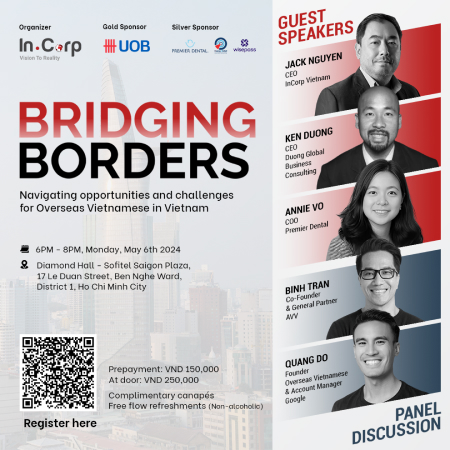

InCorp Vietnam provides business consultancy services in Vietnam including company formation, license registration, outsourcing, and flexible office solutions. Utilizing our profound industry knowledge, we assure informed decision-making and optimal positioning for your business in Vietnam.

We believe in building a lasting relationship with our partners and clients. InCorp Vietnam collaborates with the government, regulators, and industry leaders to meet the business needs of both new and existing investors.

About Us

InCorp Vietnam is a leading market entry and corporate services firm in Vietnam. We are part of InCorp Group, a regional leader in corporate solutions that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,200 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business fit into the market perfectly with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.