Vietnam’s luxury clothing industry has beckoned foreign investors with its dynamic fashion scene. Its consumer market is proliferating in Southeast Asia, with a 3.3% increase expected each year for the next five years. The country is expecting to reach 56 million middle-class individuals, establishing itself as a leading luxury fashion destination. Forecasts anticipate a substantial 35.7% growth in luxury clothing, reaching US$912 million.

Major luxury brands, like Pandora Group, are venturing into Vietnam’s market, planning a jewelry manufacturing facility producing 60 million pieces annually. This article delves into the advantages and opportunities it offers foreign investors in its thriving luxury fashion industry.

Investing in Luxury Fashion in Vietnam? Check out InCorp Vietnam’s Legal Advisory Services

Overview of the Luxury Goods Market in Vietnam

In Vietnam, the mid-range luxury fashion market is set to grow immensely, overtaking other market segments. By 2025, the market will be valued at around US$8.6 billion, with an 8.6% CAGR (Compound Annual Growth Rate).

Even with the COVID-19 challenges, Vietnam’s retail market has flourished. It is because of the salary hikes of middle-class people. From 2002 to 2020, the country’s GDP per person has grown 2.7 times, reaching nearly US$2,800.

According to Statista, Vietnam’s luxury retail market is expected to hit US$957.2 million, with an annual growth rate of 3.23% projected until 2028. Increased consumer demand for luxury fashion items creates a notable growth opportunity for brands. Consequently, the famous cities like Hanoi and Ho Chi Minh City have welcomed several luxury brands like:

- Dior

- Louis Vuitton

- Tiffany & Co.

- Berluti.

Moreover, the EU-Vietnam trade agreement has significantly favored the country’s luxury market. The investment protection agreement of 2019 eliminated 99% of all taxes and alleviated numerous regulatory barriers. As luxury items become more accessible, increased customer investment is anticipated.

In addition, the growth of luxury hotels and branded residences has attracted wealthy tourists, boosting Vietnam’s luxury shopping scene. With these developments, luxury fashion brands have found new places to shop or expand their presence in the country’s top locations.

Luxury Goods Market Trends in Vietnam

The luxury market in Asia has changed immensely with the emergence of new potentialities. Vietnam has hosted luxury brands like Louis Vuitton, Gucci, and Burberry. Specific luxury product categories have experienced significant growth in this country.

Luxury Cars

The people in Vietnam are showing interest in purchasing luxury cars. As a result, automobile companies shifted towards domestic production while continuing to import high-end vehicles. Besides, many prestigious car brands have entered the Vietnamese market, such as:

- Mercedes Benz

- Jaguar

- BMW

- Maserati

- Bentley

- Audi

- Rolls-Royce

- Land Rover

- Porsche

- Ferrari

According to a Thaco spokesperson, the company intends to open fifteen BMW dealerships in Saigon, City of Hanoi, and other major Vietnamese cities this year to increase its market share.

Luxury Watches & Jewelry

Vietnamese jewelry maintains a strong traditional influence in style and craftsmanship, with classic designs featuring diamonds and jade. However, introducing renowned international brands is often challenging for distributors and importers due to high import taxes. Foreign brands’ requirements for a minimum quantity of pieces are risky to import agents.

Overview of Luxury Watches & Jewelry

According to Statista Market Forecasts, Luxury Watches & Jewelry were projected to generate US$135.40 million in revenue in 2022. Over the 2022-2027, the market is anticipated to grow at an annual rate of 2.79%. The luxury industry has other prominent challenges besides the high import tax. It includes:

- Classic mechanical watches struggle to gain popularity due to the limited watch collectors.

- Purchase decisions are often influenced by price and design.

- Pens are the most preferred high-end gifts over other options.

- Most consumers do not commonly practice customization of products.

As per the study of the National Economics University of Vietnam in Hanoi and Ho Chi Minh City, the biggest obstacles to setting up shop in Vietnam in the early 2000s were lack of suppliers and high operating costs.

However, the purchase of luxury items by Vietnamese consumers has surged in recent years. With an estimated GDP per capita of US$3,000, Vietnam’s middle class has expanded swiftly, underscoring the country’s rich domestic market potential.

Consequently, affluent Vietnamese no longer need to travel to Singapore, Europe, or the United States to procure major brands like Louis Vuitton and Christian Dior. All are anticipated to establish outlets in Hanoi, with many already established in Ho Chi Minh City.

Trends of Luxury Watches & Jewelry

Although there are fewer jewelers initially, the Vietnamese market has seen significant improvement since 2007, with new brands entering the market. Swiss watchmakers mainly dominate the luxury watch market in Vietnam, such as Longines, Rado, Tag Heuer, Chopard, and many more.

Key Players in the Market

- Rolex, a renowned Swiss watch company, currently operates two stores in Hanoi and one in Ho Chi Minh City. With iconic watches such as the GMT-Master, Daytona, and Submariner, it has become an industry icon.

- Richemo, founded in 1988 by South African entrepreneur Johann Rupert, is a Swiss luxury goods conglomerate. The company boasts subsidiaries that produce and distribute jewelry, leather goods, pens, watches, apparel, and accessories.

- The Watches & Jewelry Houses of LVMH excel in top-tier watchmaking and high-end jewelry. These houses consistently captivate customers with their innovative creativity and expert craftsmanship.

- Chow Tai Fook: It is renowned for its exceptional product quality, ensign, value, reliability and authenticity. Its long-term commitment to innovation and craftsmanship has contributed to the group’s success.

- Swatch: Founded in 1886, Swiss watch and jewelry manufacturer Swatch Group Ltd is a leading force in the industry. It is the world’s largest watchmaker, with approximately 36,000 employees across 50 countries. Presently, Swatch operates two stores in Ho Chi Minh City.

The Rise of Vietnam in the Luxury Fashion Market

Many luxury fashion brands consider Vietnam a promising market. Salvatore Ferragamo’s flagship store in Vietnam’s capital has been a testament to this since 2006. Additionally, the country has:

- 3 Louis Vuitton stores – one in Ho Chi Minh City and two in Hanoi

- 4 Burberry stores

- 2 Gucci stores.

Over time, the luxury hotels and luxury shopping centers in Vietnam attracted affluent Asians and Westerners as major tourists. Due to its absence of customs barriers, Vietnam offers a unique advantage over India and other emerging luxury markets. With new free trade agreements reducing tariffs, this country is becoming increasingly appealing to shoppers.

Various favorable factors that influence Vietnam’s luxury clothing industry and attract foreign investors are:

- Consumer preferences change towards sophisticated, high-quality products

- Perfect balance between the demand for the offerings and quality of luxury clothing brands.

- Social media impact, influenced by celebrities’ endorsements and brand promotions

- Consumers’ spending ability

- Sustainable commitment to adopt eco-friendly and recycled products

Shifting Consumer Preferences and the Rise of the Middle Class

Asia is the primary engine for global consumption growth. Neglecting Asia could mean overlooking half of the worldwide consumption landscape. The McKinsey Global Institute estimates a US$10 trillion consumption growth opportunity over the next decade.

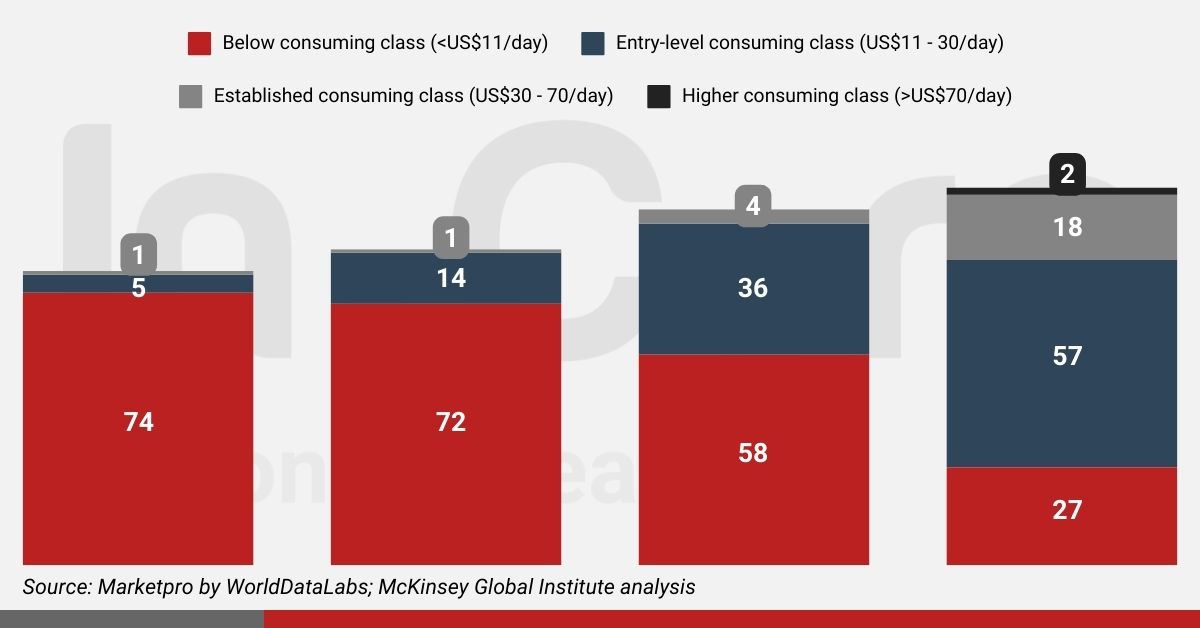

The top two tiers of the consuming class, spending US$30 or more daily, are growing fastest and might make up 20 percent of Vietnam’s population by 2030. Vietnam could add 36 million people to the consuming class in the next decade.

The Centre for Economics and Business Research (CEBR) predicts that Vietnam will surpass Indonesia’s Southeast Asian economy by 2036. Vietnam has laid out a five-year plan from 2021 to 2025 to maintain its economic development momentum.

The plan prioritizes bolstering the manufacturing sector through active engagement in global supply chains, cultivating trade alliances, and broadening export diversity. The country’s economic outlook has improved due to the growth of its middle class. Additionally, Vietnam has significantly enhanced its business environment, expanded market access, and relocated supply chains to lower-cost countries.

Increasing Demand for Luxury Fashion

Many famous luxury clothing brands have noticed consumer demand in Vietnam in recent eras. Below are some of the examples:

- Salvatore Ferragamo: Their main store in Vietnam’s capital has succeeded since it opened in 2006. They witnessed ample opportunity in Vietnam’s luxury goods market, opening their fifth store there.

- Louis Vuitton is also doing well in Vietnam. It has 3 stores: one in Ho Chi Minh City and two in Hanoi.

- Gucci and Burberry have two and four stores, respectively.

- Ermenegildo Zegna has just started selling its products in Vietnam. They opened their first store in Ho Chi Minh City and are planning to open another one in Hanoi soon.

Strategic Advantages for Foreign Investors in Vietnam

Cost-effectiveness and Competitive Manufacturing Capabilities

According to ASEAN’s trade data for 2020, Vietnam was the European Union’s 15th largest trading partner. During that time, it typically imported aircraft, machinery, cars, and pharmaceuticals from the EU while exporting shoes, electronics, and textiles to the EU.

In 2019, the EU invested US$6.1 billion in foreign direct investment (FDI) in Vietnam’s industrial processing and manufacturing sector. Through successful multilateral diplomacy, Vietnam has skillfully managed its relations with China and the United States. It offers significant financial benefits over China, such as:

- Favorable labor rates

- Stable currency

- Considerable tax incentives

Expanding Infrastructure and Logistics Capabilities

Vietnam’s potential as a robust market for international trade is evident from its growing infrastructure and logistics capacities. With a sea area covering over 1 million square kilometers, it features a diverse network of almost 50 seaports, including two international terminals:

- Cai Mep International Terminal

- Hai Phong International Terminal

Read More: Top Megaports and Their Impact from Saigon to Hai Phong

Unlike other ASEAN nations, which allocate an average of 2.3% of their GDP to infrastructure projects, Vietnam devotes about 6% to such initiatives. From 2022 to 2027, Vietnam’s infrastructure is expected to expand at an annual rate of approximately 4%.

Vietnam has forged trade agreements with neighboring countries and actively engages in ASEAN to lower regional tariffs. The EU-Vietnam Free Trade Agreement (EVFTA), signed with the EU, seeks to boost investments between Vietnam and Europe.

Read More: Guide to Vietnam’s 16 Active Free Trade Agreements

Growing Domestic Market and Regional Accessibility

In the coming years, 36 million more people can join Vietnam’s consumer segment and will spend at least US$11 per day on purchasing power parity (PPP) terms. In 2000, less than 10% of Vietnam’s population was part of the consumer segment, but now it’s up to 40%. Estimates indicate that by 2030, this percentage could nearly reach 75%.

Comparison with Neighboring countries

In high-growth markets such as Japan, Greater China, Singapore, and South Korea, the luxury industry has experienced significant growth. However, luxury brands have not been as successful in replicating these efforts in the region’s fast-developing markets.

Compared to China or Japan, Vietnam’s luxury goods market is smaller, generating US$976 million in revenue in 2021. China’s luxury market generated a revenue of US$43.5 billion in the same year.

The COVID-19 pandemic significantly impacted luxury markets globally. According to Euromonitor International’s Luxury Goods 2021 report, there was a 15% decline in the value of the global luxury goods market in 2020.

However, projections suggest that the luxury goods market has rebounded and generated revenues worth US$911.50 million in 2022. Specifically, luxury fashion, the largest segment in the luxury goods market, was expected to see a spike worth US$274.60 million in the same year. Furthermore, the luxury goods market is forecasted to grow annually by 3.52% (CAGR 2022-2027).

Navigating Challenges and Risks

Vietnam grapples with counterfeit products, often from China, and illegal importation of authentic goods sold in unlicensed stores. Vietnamese authorities recognize the need to ban counterfeit luxury goods but lack effective measures. Negotiations for Vietnam’s entry into the World Trade Organization in the 1995 Civil Code included provisions for intellectual property protection.

Although not as severe as in neighboring countries like China or Thailand, the counterfeit issue in Vietnam still threatens the luxury market’s growth. Besides, The pricing of imported products typically includes the following components:

- Fees levied by import agents usually range from 1 to 2% of the invoice.

- The type of product determines customs duty.

- The landed cost of goods, subject to VAT, ranges from 10% to 15% upon title transfer.

- Taxes on luxury or consumption items, notably automobiles, beer, and alcoholic beverages.

Read More: Fundamental Insights: Value-Added Tax (VAT) Landscape in Vietnam

Addressing Potential Challenges Faced by Foreign Investors

The foreign investors in Vietnam may encounter intellectual property (IP) protection challenges. While Vietnam’s IP laws comply with international standards outlined by the Trade-Related Aspects of Intellectual Property Rights (TRIPS) Agreement, enforcement could be strengthened. Raising awareness about IP protection among Vietnamese consumers is vital.

Vietnam has been included on the U.S. Trade Representative’s Special 301 Watch List for more than ten years, indicating the necessity for enhanced IP measures. The 2020 Notorious Markets report identifies Dong Xuan and Ben Thanh Markets as areas of concern. Companies should prioritize securing IP protection before entering the Vietnamese market to address these challenges. Patents, trademarks, designs, and geographical indications must be registered with IP Vietnam.

Protecting your Patents, Trademarks, Designs, and Geographical Indications? Check out InCorp Vietnam’s Trademark Registration Services

Mitigating Risks Through Strategic Planning and Partnerships

For manufacturers, strategic planning and local partnerships are crucial in risk mitigation. Sirois Tool acknowledges the advantages of establishing and nurturing local, regional, and national partnerships with vendors and customers. Collaboration with local businesses provides benefits over distant, low-cost suppliers.

Forming robust relationships with local authorities and stakeholders is essential for conducting business in Southeast Asian countries. Organizations like the US-ASEAN Business Council and OECD drive economic growth and foster connections between businesses and regional stakeholders in Southeast Asia.

Conclusion

With the burgeoning middle class and rising disposable incomes, the Vietnamese population is poised to increase its spending power. As interest in luxury items like watches and jewelry grows, these products are anticipated to become staples in their lives. Although the luxury goods market is in its early stages, Vietnam has laid the groundwork for foreign luxury brands to exploit untapped opportunities within the country.

Furthermore, Vietnam’s strategic location, cost-effectiveness, and improved infrastructure enhance its appeal to foreign investors in Southeast Asia. Strengthened trade ties with the EU further contribute to the favorable investment climate. To capitalize on Vietnam’s luxury fashion growth, foreign investors must prioritize intellectual property protection, establish local partnerships, and remain informed about evolving market dynamics. These strategies will enable them to navigate and leverage the lucrative opportunities offered by Vietnam’s thriving luxury clothing market.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly