The World Economic Forum estimates that Southeast Asia will have 140 million new consumers from 2020 to 2030 according to the World Economic Forum. In this region, about 1 in 6 households will be a potential consumer by then. The Association of Southeast Asian Nations (ASEAN) is helping SEA economies to become more integrated and attract foreign investment.

Moreover, as per research conducted in Thailand, Indonesia, Malaysia, the Philippines, Singapore, and Vietnam, predicts that the internet economy – which includes e-commerce, food delivery, and financial services will be worth USD 360 billion by 2025.

Vietnam is an active member of several Foreign Trade Agreements in the region and is one of the fastest-growing economies. Some reasons for its success include the rapidly growing young population and the global shift toward diversifying supply chains. Here are a few aspects that foreign investors might want to take into consideration before setting up a business in Vietnam:

Understanding Future Growth Prospects for investing in Vietnam

Vietnam will have the second-largest economy in Southeast Asia after Indonesia by 2036, according to the Centre for Economics and Business Research (CEBR) World Economic League Table 2022.

The current five-year plan(2021-2025) is aimed at the seamless implementation of the present economic development framework. Moreover, manufacturing is expected to be an integral part of the global supply chain; therefore, providing opportunities to diversify exports and foster trade partnerships.

According to Vietnam Investment Review (VIR), it is estimated that the country will achieve high-income status by 2045. In order to achieve this milestone, the country needs to grow at an average annual rate of approximately 5% per capita. Vietnam is expected to grow at a 6.5% annual rate during the next decade, according to its five-year plan.

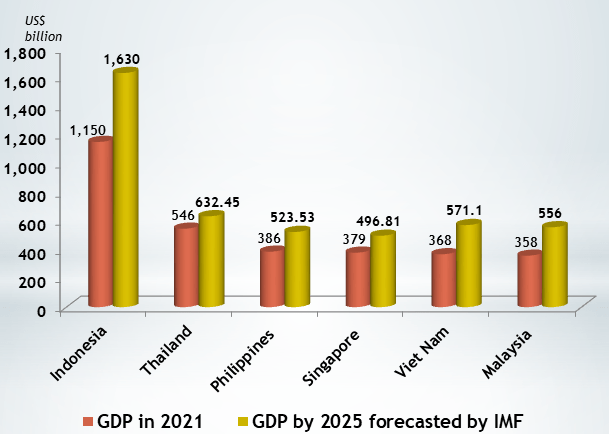

The IMF (International Monetary Fund) predicts Vietnam will rank third in SEA in terms of GDP by 2025, behind Indonesia (USD 1.63 trillion) and Thailand (USD 632.45 billion). The country is expected to outperform Malaysia, the Philippines, and Singapore.

Moreover, it is predicted that Vietnam’s economy will surpass Thailand’s by 2028, whereas it will outperform Switzerland, Australia, Belgium, Sweden, and Poland by 2036.

Up to 50% of Fortune 500 companies are expected to relocate to Vietnam within the next decade. Various Asian countries, as well as European, Russian, and US countries, are expected to contribute about 70-75% of registered investment capital by 2030.

Ease of Doing Business – challenges remain

The ranking of Vietnam’s ease of doing business, reported in 2020, is 70th out of 190 countries. However, there are some challenges that need to be considered while investing in Vietnam:

- Tedious administrative process

- The Vietnamese legal system has gray areas

- Ineffective enforcement of Intellectual Property Rights (IPRs)

- Insufficient infrastructure

- Deficiency of skills

- Barriers of language

As per the Ease of Doing index, it is easier to do business in Vietnam (70) than in Greece (79), according to Tradingeconomics.

Company Setup Options

- Company with 100% foreign ownership: An enterprise with 100% foreign investment in Vietnam can only exist as a Limited Liability Company (LLC) or Joint Stock Company (JSC), the two more popular entities among foreign investors. It takes almost 40 to 60 days to establish an LLC or JSC in the country.

- Local Company: Having a local company registered in Vietnam offers several benefits, one of which is the ability to complete company registration much faster. Generally, it takes approximately 20 working days to set up a local company in Vietnam. However, before registering a company, foreign companies must obtain the Investment Registration Certificate (IRC).

There are often local laws that apply to businesses with a limited foreign ownership policy. It is pertinent to note that some of these business lines are not governed by clear laws and do not fall under a specific category. For instance :

- Business in the spa industry

- Getting into the gym business

- Providing online teaching services

Accordingly, foreign investors must seek approval from the relevant Ministry if their company falls within one of these indeterminate categories. Furthermore, the registration process for such a company will be time-consuming.

An Overview of Tax Incentives

Vietnam has advocated high-tech & agriculture projects extensively for the last few years. As a result the government offers very attractive corporate tax reductions for companies eligible, who plan on setting up their tech business as well as agriculture business in Vietnam. These businesses are qualified for 15 years of CIT reductions, as described below:

CIT incentives for the first 15 years, in detail:

- First 4 years: exempt from CIT completely

- Next 9 years: 50% tax reduction of the 10% rate

- Next 2 years: 10% CIT

About Us

InCorp Vietnam is a leading provider of global market entry services. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,100 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business perfectly fit into the market with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.