Accounting tasks hold a vital position within a business, thus they need to be held sufficiently in order to sustain the company. Handling accounting services can be a challenging task because there are so many things to consider, such as managing payroll, accounts receivable, and accounts payable. Therefore, the perfect solution to focus on the fundamentals of the business and to ensure the accounting services are completed is accounting outsourcing in Vietnam.

Read About InCorp Vietnam’s Accounting Outsourcing Services in Vietnam

In today’s vigorous business environment, there are many aspects to consider when setting up and running a company in Vietnam. For startup companies, the main goal is to focus on the core business to kickstart successfully and achieve their goals in the business market. Assumptions, confusion, and mistakes can lead to negative outcomes for startup companies when figuring out the system in Vietnam. Hiring a qualified team to do this job for you can turn these undesirable points into success within your company.

First, let’s explore about the tax system in doing business in Vietnam as follows:

What are the 5 Most Common Taxes in Vietnam?

Corporate Income Tax – CIT

Corporate Income Tax (CIT) in Vietnam is a direct tax levied on the profits earned by companies and other legal entities from their business operations. The standard CIT rate in Vietnam is 20%. There may be preferential rates available (such as 10%, 15%, or 17%) for certain qualifying businesses or business activities, often as an incentive to encourage investment in specific sectors or regions.

Read More: Corporate Income Tax (CIT) in Vietnam: A Comprehensive Overview

Value-Added Tax – VAT

Value-Added Tax (VAT) in Vietnam is a consumption tax applied to the value added at each stage of the supply chain, from production to the point of sale. It is an indirect tax on the consumption of goods and services. Vietnam typically has several VAT rates including the standard rates (commonly 8% and 10%) and preferential rates (0%, 5%) for essential goods and services, as well as special categories that may be exempt or subject to a different rate.

Read More: 2023 Essential Insights: Vietnam’s Value-Added Tax (VAT) Landscape

Personal Income Tax – PIT

Personal Income Tax (PIT) in Vietnam is a direct tax levied on the income of individuals. PIT in Vietnam is progressive, with rates ranging from 5% to 35% depending on the individual’s income level. There may also be a flat rate for non-residents or for certain types of income.

Read More: Personal Income Tax (PIT) in Vietnam: A Guide for Foreign Investors

Foreign Contractor Withholding Tax – FCWT

Foreign Contractor Withholding Tax (FCWT) is a specific tax regime applied to foreign businesses and individuals (contractors) earning income from providing services or conducting business activities in Vietnam. The Vietnamese contracting party typically withholds this tax. It is a combination of Value-Added Tax (VAT) and Corporate Income Tax (CIT) or Personal Income Tax (PIT), depending on the nature of the income and the status of the foreign contractor.

Business License Tax

In Vietnam, the Business License Tax is an annual charge levied on various business entities based on their registered or investment capital. Applicable to companies, partnerships, sole proprietorships, and foreign entities’ local offices, it is a mandatory fiscal obligation reflecting the capital declared during business registration.

Download the detailed guide about Taxation & Compliance Deadlines in Vietnam now!

Tax Incentives in Vietnam

Businesses that qualify for Vietnam’s corporate tax incentives are granted a four-year tax exemption from the start of their operations. This significant tax relief can be obtained in two ways: firstly, for income earned from new public sector projects in disadvantaged or extremely disadvantaged areas, as detailed in Decree No. 218/2013/ND-CP; secondly, for high-tech and agricultural enterprises using advanced technology, upon receipt of the requisite High-tech Enterprise or High-technology Agricultural Enterprise Certificate. The exemption period kicks off in the year the certification is awarded, offering a substantial financial advantage during the crucial early years of business growth.

To be eligible for tax incentives in Vietnam, businesses must secure two crucial certifications: the Certificate of High-tech Enterprise and the Certificate of Agriculture Enterprise Applying Technologies. Obtaining these certifications involves thorough and time-consuming application processes, reflecting the strict criteria set by the authorities.

Read More: Tax Incentives in Vietnam: A Guide for Foreign Companies (2023 Update)

What is Accounting Outsourcing Services in Vietnam?

Accounting is the organized process of gathering, compiling, evaluating, and communicating both financial and non-financial data about a company’s operations. It entails keeping track of adjustments to resources, workflows, and the results of commercial and production operations. Accounting has the function of offering useful information for decision-making, assessing the efficiency of business operations, and assuring compliance with pertinent laws.

Outsourcing accounting services in Vietnam involves hiring a third-party service provider or accounting firm to handle various financial and accounting tasks on behalf of a business. This outsourcing arrangement allows companies to delegate accounting responsibilities to experts outside of their organization, often for reasons such as cost-efficiency, expertise, and time-saving.

Which Accounting Outsourcing Services Are Prioritized?

Payroll Processing

Your business will perform better when you outsource your company’s payroll. Payroll in Vietnam requires a certain level of knowledge and expertise, especially when the Vietnamese Laws are constantly changing. An accounting outsourcing provider is familiar with all governmental requirements, payroll essentials, and HR nuances.

Want to find more about Payroll Processing? Check out InCorp Vietnam’s Payroll Outsourcing Services

The payroll process can be complicated and time-consuming for untrained HR personnel especially when the payroll involves leave credits, benefits, timesheets of different locations, etc. Having a professional consultant to oversee your payroll processing in Vietnam provides you with more time and resources to perform more valuable tasks for business growth.

General Accounting and Bookkeeping

Bookkeeping and general accounting need to complement each other to deliver the best result. However, it is sometimes hard to achieve. This is because bookkeeping is often considered one of the most laborious tasks and thus human errors are common. And the bad news is, a slight mistake in bookkeeping can jeopardize the entire accounting process.

You can avoid this type of problem by outsourcing this particular function. An accounting outsourcing partner ensures that they properly record each of your business transactions, enabling easy tracking and tracing. Your accounting services partner also has the right accounting software for bookkeeping and general accounting automation.

Financial Report and Management Report

Investors and clients can get a better understanding of your business’s financial condition through a financial report and management report. Therefore, these reports are vital. You need to generate the recorded data carefully from bookkeeping on a daily basis.

If you have already outsourced the main accounting and bookkeeping functions to an outsourcing firm, you should just delegate the financial report and management report writing to the same professional, since the same provider has all the important data in one place.

Nominee Chief Accountant

The chief accountant holds full responsibilities, including overseeing daily operations, signing essential financial documents, collaborating with tax authorities and auditors, ensuring statutory compliance, and managing communications with local tax authorities, while also supporting the annual audit process.

Pros of Accounting Outsourcing in Vietnam

Less expenditure

Any wrong calculations can cost the company, so it is important to ensure that the departments that hold this responsibility are qualified and professional.

When you opt for outsourcing, a professional provider assumes this role, delivering ample service to complete the job. While there is an initial payment for the outsourcing team, it reduces the likelihood of incurring penalty charges due to internal mistakes.

Increased profits

Focusing on the core business within your company that involves profits and clients holds more importance in comparison to the administrative tasks that involve accounting.

Having a provider that takes care of the accounting tasks, so you can spend more time on a high-level service within the organisation, could potentially be the motive behind increasing profits.

Directing your energy to the clients, in the beginning, leads to an increase in profits in the long run.

Minimized risks

Frequent errors and mistakes may result in the company losing clients or, in the worst-case scenario, completely shutting down the business.

To address this, outsourcing an accounting team in Vietnam takes responsibility. The skilled and professional team minimizes risks to safeguard the company’s reputation.

Business decisions are made faster

A professional accounting team ensures punctual payments, reducing stress. Errors in various accounting areas can impact business performance. Outsourcing ensures timely payments and precise decision-making, meeting deadlines. Because we have the advantage of operating in this field, we can support your company with the appropriate accounting staff to fulfill this goal.

Cons of Accounting Outsourcing in Vietnam

The cons of accounting outsourcing are not common and can be overcome quite easily. The lack of communication is one of the cons because you’re unable to communicate with the provider frequently and minor misunderstandings may occur. So, it will sometimes give business owners a false sense that they are losing control or oversight of their accounting matters.

Read More: Top 10 Drawbacks of Doing Business in Vietnam for Foreign Investors

How to Outsource Accounting Services in Vietnam?

- Identify Your Motivation: Determine the key reasons driving your decision to outsource, which may include cost reduction, improved business performance, or access to specialized skills.

- Select the Right Partner: Choose an outsourcing partner aligned with your business goals, considering factors like cultural compatibility, communication capabilities, technology infrastructure, and track record.

- Choose the Outsourcing Model: Decide on the outsourcing model that best suits your needs, whether it’s freelancers, project-based, business process outsourcing (BPO), or the build-operate-transfer model.

- Involve Your Local Team: Communicate openly with your local team about the outsourcing strategy, addressing any concerns and empowering them with your firm’s vision.

- Prepare an Implementation Plan: Develop a comprehensive outsourcing implementation plan that outlines project specifications, guidelines, and communication strategies. Collaborate with your outsourcing provider to bridge any gaps.

Read More: Top Business Process Outsourcing (BPO) Company: Benefits and Services in Vietnam

About Us

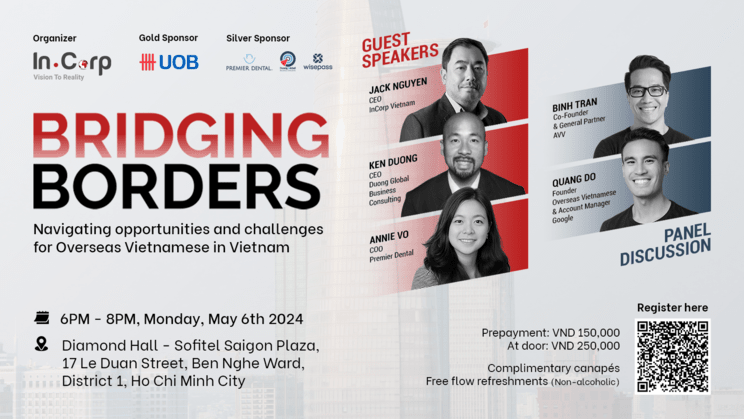

InCorp Vietnam is a leading market entry and corporate services firm in Vietnam. We are part of InCorp Group, a regional leader in corporate solutions that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,200 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business fit into the market perfectly with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.