As Vietnam presents a more and more open economy to attract foreign investment, the government has created some interesting tax incentives. These include paying no taxes for a certain period of the initial establishment in the country, involving tech-based industries, and investing in underdeveloped geographical areas of the country. Understanding and applying for these tax incentives is no easy feat. This guide will provide details for foreign businesses looking to expand their business to Vietnam, that fit the government.

When compared to other countries in Southeast Asia, Vietnam’s tax incentives stand out and create a more favorable condition for foreigners to expand their business operations or invest in new projects.

Through reading this article, you will have a bigger picture of tax incentives in Vietnam, which will help you take advantage of the tax incentives offered for your business expansion and investment in Vietnam.

Investing in Vietnam? Find out about InCorp Vietnam’s Accounting & Taxation Services

Taxation in Vietnam

In general, there are three common taxes in Vietnam:

– Corporate Income Tax

– Personal Income Tax

– Value-Added Tax

The biggest incentives are regarding Corporate Income Tax incentives for high-priority tech-based industries.

Overview of Corporate Income Tax (CIT)

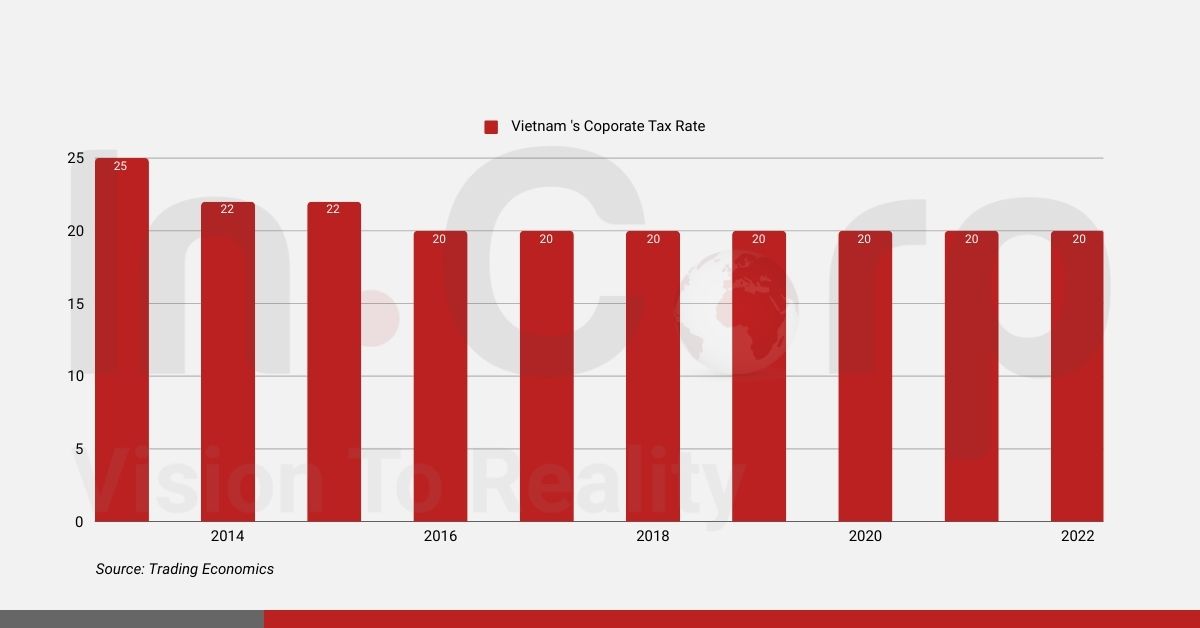

Drawn by the steadily declining corporate income tax rate, an increasing number of foreigners are setting up businesses in Vietnam. Witnessing a significant drop from 32% in 2000 to 20% in 2018, the Vietnamese CIT rate has become an attractive incentive. The following details outline the changes in Vietnam’s Corporate Tax Rate from 2014 to 2022:

Except for Singapore, the CIT rate in Vietnam is lower than most countries in the region, including Malaysia, Thailand, Indonesia, the Philippines, and Japan. The following shows the CIT rates in Vietnam compared to other neighboring countries:

| Country | Corporate Income Tax Rate (%) |

| Vietnam | 20% |

| Indonesia | 22% |

| Malaysia | 24% |

| China | 25% |

| Philippines | 30% |

Personal Income Tax (PIT)

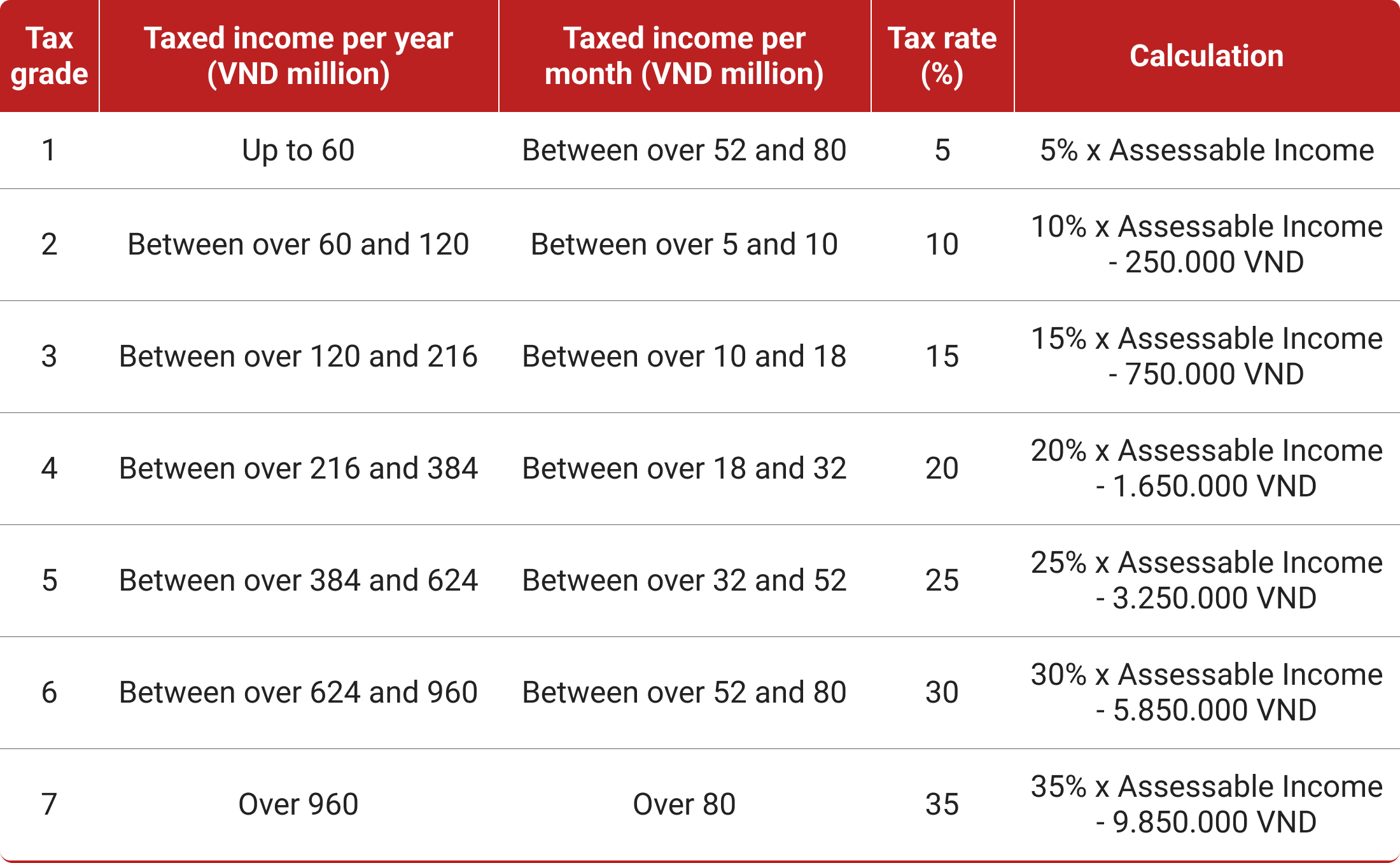

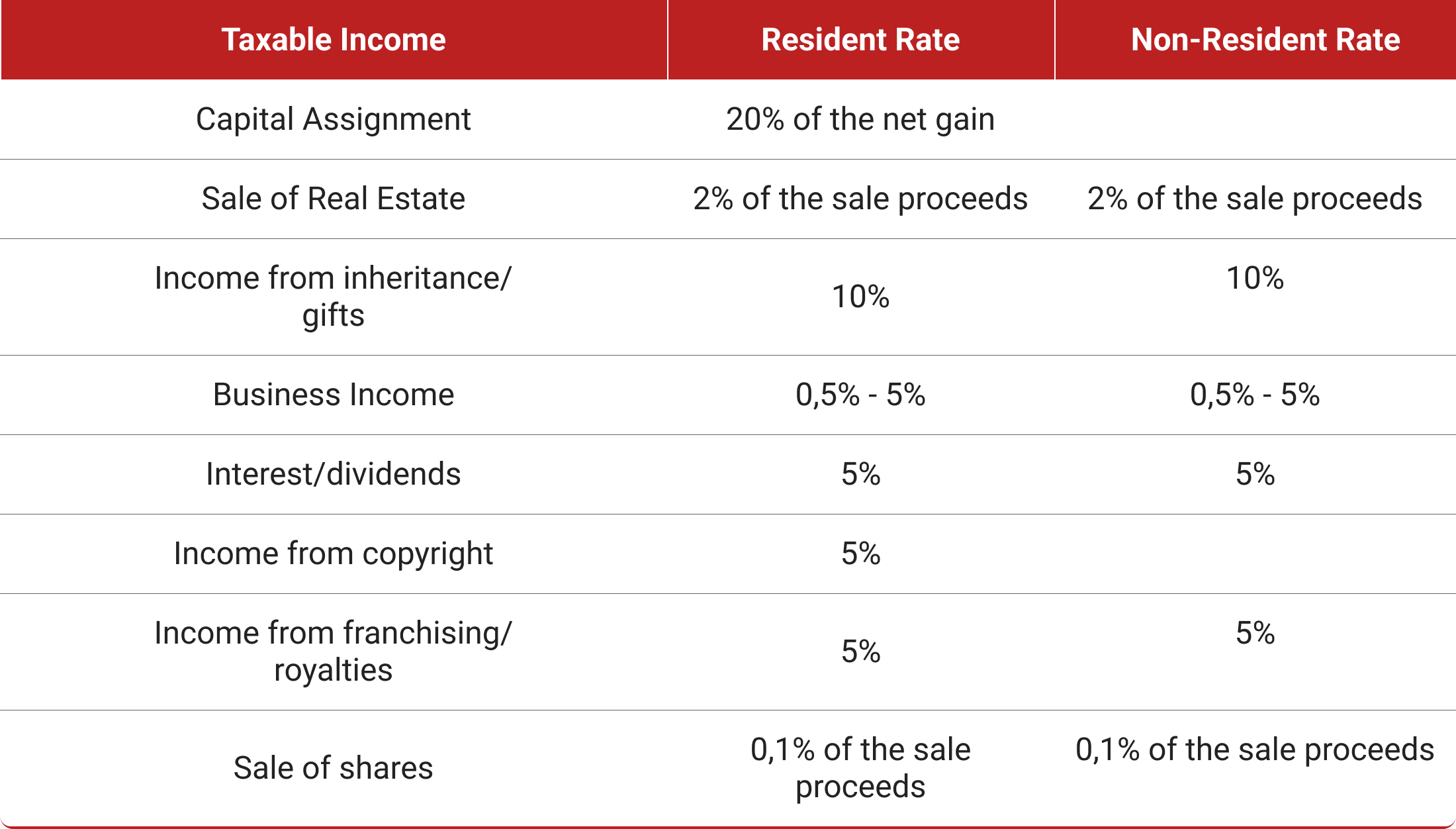

In Vietnam, your residency status and income type play crucial roles in determining your personal income tax (PIT). A key figure to keep in mind is 183 days. For resident taxpayers, PIT is levied at progressive rates from 5% to 35%. In contrast, non-residents are taxed at a flat 20% rate on their income sourced from Vietnam.

Business income in Vietnam, exceeding VND 100 million, is subject to varying tax rates across different sectors. Additionally, individuals can legally reduce their payable personal income tax through two methods: deductions for family circumstances and deductions for donations.

Value Added Tax (VAT)

Value-added tax is considered the most prevalent and indirect tax in Vietnam. Consumers purchasing goods and services in Vietnam will be imposed a VAT of 0%, 5%, or 10%, depending on the types of goods and services.

In most cases, a uniform VAT rate of 10% is applicable to the majority of products. Items and services falling under the state’s emphasized and incentivized policies are subject to a reduced VAT rate of 5%. Moreover, a VAT rate of 0% is in place for goods and services that are exported along with their delivery.

2025 Update: As per Decree No.180//ND-CP from the National Assembly of Vietnam, there has been a reduction in the VAT rate for eligible goods and services from 10% to 8%, still effective from January 1st, to June 30th, 2025. This policy aims to enhance economic revival and growth following the pandemic. Nevertheless, there exist three sets (Appendix I, II, and III) of taxable products in the decree above that are excluded from this tax reduction. These items pertain to various categories such as information technology and financial services.

In Vietnam, a clear differentiation exists between products that are VAT-exempt and those that are subject to a 0% VAT rate, as outlined in Circular 219/2013/TT-BTC. Precisely, exports and their accompanying delivery are categorized with a 0% VAT rate, and businesses engaged in this industry still need to fulfill the VAT registration and reporting procedures.

Besides, if you are a foreign business, you need to know about VAT refunds overpaid VAT as follow:

Corporate Income Tax (CIT) Incentives

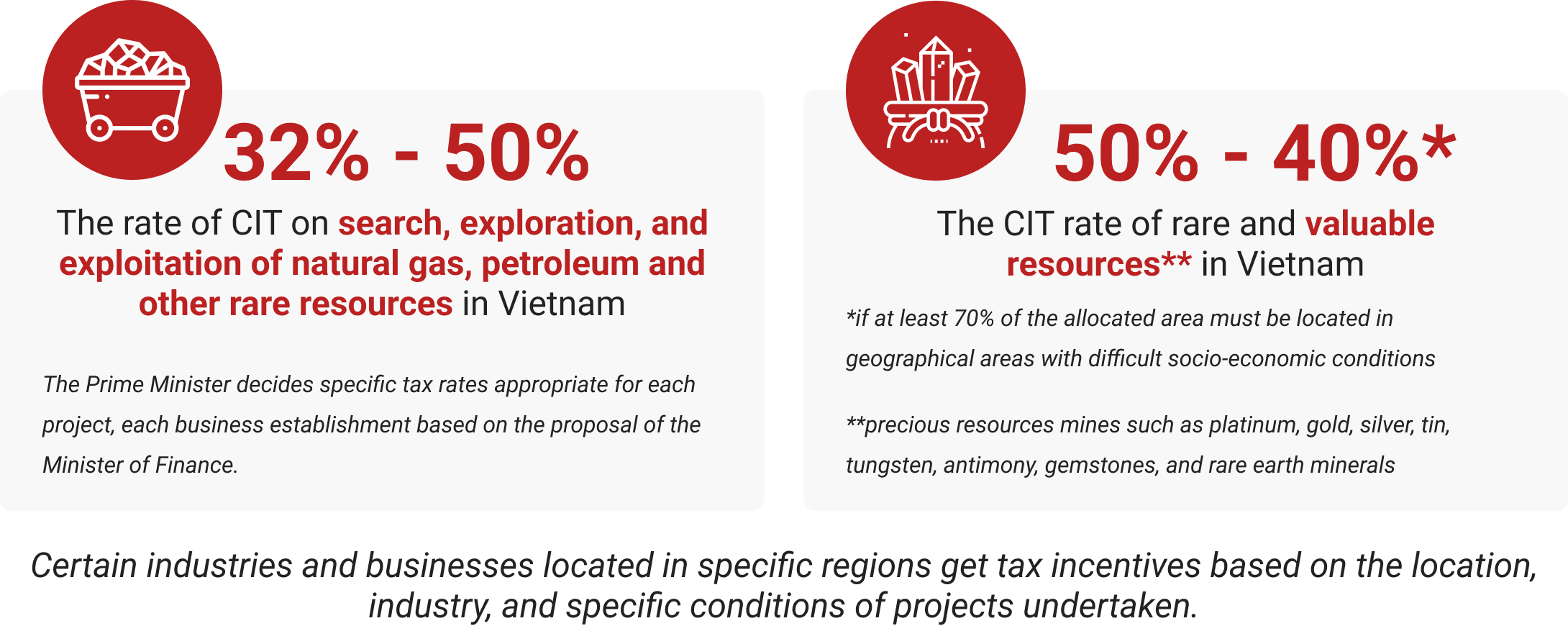

CIT is payable annually according to the tax law in Vietnam based on each industry. Concerning the corporate tax rates, investors are encouraged to take advantage of the different tax incentives offered by the Vietnamese government to businesses engaged in the encouraged sectors that include:

If your business qualifies for corporate tax incentives in Vietnam, you can benefit from significant tax exemptions during the initial years of operation. Two primary methods to achieve these exemptions are:

- Geographically Disadvantaged Areas: Enterprises operating new projects in areas classified as disadvantaged or extremely disadvantaged, as outlined in the Appendix of Decree No. 218/2013/ND-CP, are eligible for tax incentives.

- High-Tech and Agricultural Enterprises: Businesses recognized as high-tech enterprises or agricultural enterprises applying high technologies can receive tax exemptions or reductions. These benefits begin from the year they obtain the respective High-tech Enterprise Certificate or Agriculture Enterprise Applying High Technologies Certificate.

Tax Holidays Overview:

- Total tax exemption for the first 4 years, followed by a 50% tax reduction for the next 9 years.

- Alternatively, a 4-year tax exemption with a 50% tax reduction for the next 5 years.

- Another option includes a 2-year tax exemption, followed by a 50% tax reduction for the next 4 years.

These tax holidays are strategically designed to stimulate business growth and investment in key sectors and locations.

Incentives in Specific Regions

Vietnam’s government has instituted a range of incentives to spur capital influx and development in select regions, primarily through tax exemptions. These incentives are tailored to the specific economic profile and needs of each region or industry.

The extent of these benefits varies, taking into account factors such as infrastructure quality, accessibility, and the developmental stage of the economic zone. This results in differing levels of incentives for disadvantaged and very disadvantaged areas.

Investments in both these types of regions are eligible for preferential Corporate Income Tax rates and tax holidays. The scale of these incentives is directly linked to the degree of underdevelopment in these areas, providing a greater push where it’s most needed.

Non-Tax Based Incentives: Customs and Land Rental Benefits

Exemptions on Customs Duties

Foreign businesses have the opportunity to bypass import duties, opening doors to greater innovation and international collaboration. This exemption applies to businesses that import goods in these transformative categories:

- Technology Trailblazers: Goods brought in as raw materials and supplies for software production, specifically for products that aren’t domestically available, enjoy a duty-free status. This fosters a thriving environment for cutting-edge software development.

- Pioneers of Science and Technology: Importing goods for scientific research and technological development? These imports are exempt from duties, encouraging businesses to push the boundaries of research and innovation.

- Global Trade Facilitators: For those engaged in export processing contracts with international partners, importing the necessary goods comes without the burden of import duties, facilitating smoother, more cost-effective international trade operations.

Land Rental Incentives

Investment projects across Vietnam can now tap into an array of land rental exemptions, provided they align with certain strategic criteria, such as investing in key economic sectors or selecting designated locations. These exemptions are not just incentives; they’re catalysts for growth in areas that need it most:

- Full Operational Period Exemption: Projects that fall under especially encouraged investment sectors in regions facing significant socioeconomic challenges are eligible for complete land rental exemptions throughout their operational life.

- 15-Year Exemption for Special Encouragement Sectors: Projects investing in areas with considerable socioeconomic difficulties, particularly those on the special investment encouragement list, benefit from a 15-year hiatus on land rental charges. This also extends to investments in exceptionally challenging regions under the investment stimulus sectors.

- 11-Year Strategic Boost: Eligible projects within the special investment encouragement sectors, especially those in regions grappling with socioeconomic challenges, can enjoy an 11-year break from land rental charges.

- 7-Year Relief for Challenging Areas: Projects that are brave enough to venture into areas with extremely tough socioeconomic conditions receive a generous 7-year exemption on land rentals.

- 3-Year Support for Urban and Environmental Projects: For projects listed under the investment stimulation sectors, a 3-year exemption is available, particularly for those relocating due to urban planning needs or environmental concerns.

Special Tax Incentives: Software Production and ICT Companies

In a bold move to reshape the investment climate, the Prime Minister of Vietnam has unveiled Decision 29/2021/QD-TTg. This groundbreaking directive sets out the specific levels, durations, and conditions for special incentives aimed at investment projects. These incentives are meticulously crafted, focusing on projects that meet precise legal criteria, including substantial investment capital, deployment of high technology, facilitation of technological transfers, enhancement of added value, and active participation in the Vietnamese enterprise value chain.

This innovative regulation is poised to transform the investment ecosystem. It’s strategically designed to attract foreign investors wielding significant capital and advanced technologies, enticing them to forge long-term commitments with Vietnam. More than just an investment magnet, this policy is a catalyst for technological advancement, aiming to accelerate the process of tech transfer. It also seeks to amplify the ripple effects of Foreign Direct Investment (FDI), ensuring that these ventures contribute substantially to Vietnam’s broader economic dynamism and global integration.

In order to qualify for these tax incentives in Vietnam you must apply for two certifications:

– Certificate of High-tech Enterprise

– Certificate of Agriculture Enterprise Applying Technologies

The Vietnamese government has prioritized software and IT industries as part of its economic development and offers attractive tax incentives for IT companies. These CIT incentives are as follows:

CIT incentives for the first 15 years, in detail:

– First 4 years: exempt from CIT completely

– Next 9 years: 50% tax reduction of the 10% rate

– Next 2 years: 10% CIT

– From 16th years of operation and onward: Standard 20% CIT

For example, in the first 15 years

– From 2030 to 2033: No CIT paid

– From 2034 to 2042: 5% CIT (in regulations it’s stated as 50% of the 10% CIT)

– From 2043 to 2044: 10% CIT is paid

– From 2045 onward: 20% CIT

Discover Comprehensive Information on Procedures for Tax Incentives in Vietnam

What next?

To go through the incorporation process and apply for these special incentives foreign firms must employ experienced tax specialists in the country with a long track record in the field. If you think your company fits the requirement laid out above, get in touch by filling out the form below.

clients worldwide

professional staff

incorporated entities in 10 years

compliance transactions yearly