The personal tax system for foreigners living in Vietnam involves special tax rates, calculations, and procedures. These calculations and procedures can be much more difficult for you to comprehend if you do not have specialized knowledge. It means that this kind of tax system for expatriates requires expert guidance to navigate. This guide clarifies the intricacies of tax regulations, helping foreigners understand their monthly and yearly tax obligations.

Read More About InCorp’s Tax Outsourcing Services for Foreign Firms

Personal income tax rules in Vietnam apply to both tax residents and non-residents based on their time spent in the country. This article outlines essential regulatory aspects of personal income taxes for expatriates to clarify your tax responsibilities.

What is Personal Income Tax?

The personal income tax is what an individual needs to pay to the Vietnamese Department of Taxation based on the amount of income earned.

Sources of income that are subject to personal income tax in Vietnam include salary and wages, capital investments, capital transfer, franchising income, inheritance, etc.

Who Are Considered Tax Payers in Vietnam?

The level of income decides how much in taxes an ex-pat has to pay. Also, based on Article 2 of the Law on Personal Income Tax, ex-pats who are deemed tax residents in Vietnam must meet one of the following conditions:

- Expats stay in Vietnam for no fewer than 183 days within a 12-month period, starting from the first arrival in Vietnam

- Expats with permanent residency in Vietnam that is recorded on a Temporary Residence Card or a Permanent Residence Card

- Expats who have signed rental contracts of over 183 days

If an ex-pat does not meet any of the mentioned conditions, he or she will be regarded as a non-tax resident in Vietnam.

Related article: 5 Challenges of Accounting and Tax Compliance in Vietnam

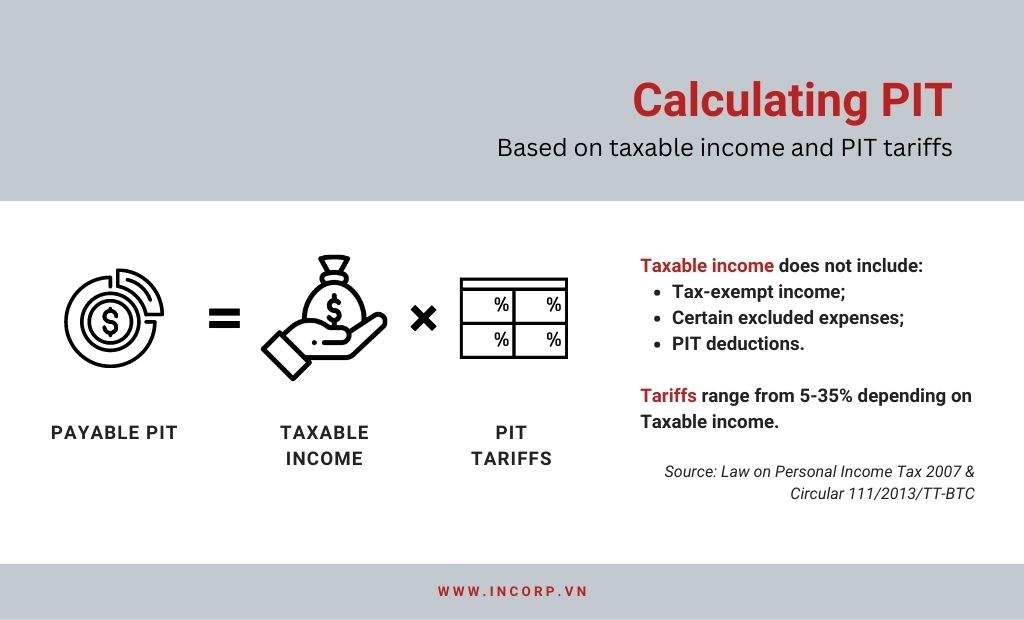

How to Calculate Expat’s Personal Income Tax in Vietnam

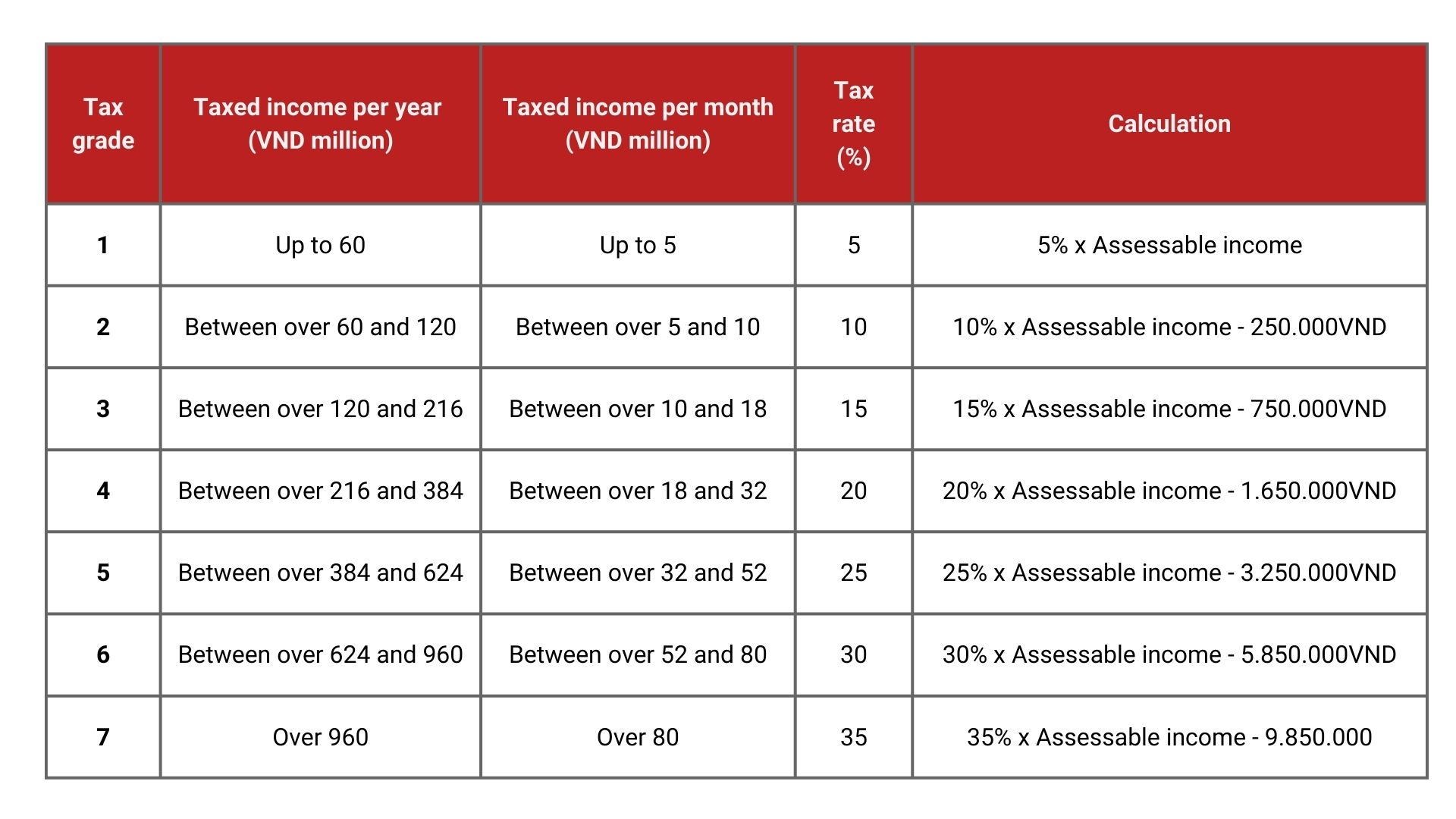

The monthly salary of an ex-pat is also the monthly taxable income in Vietnam. For tax residents, their monthly taxable income is taxed at a progressive rate of 5-35%; for non-tax residents, it is a fixed 20%.

Calculate Your Taxable Income Rate

Monthly Personal Income Tax Calculation

Tax Rates of Other Personal Incomes for Tax Residents

For other income, the tax rate is between 0.5% and 10%:

- Non-bank interest: 5%

- Dividends: 5%

- Business income: 0.5-5%

- Capital transfer: 20% of the profit

- Public share sales: 0.1% of the profit

- Real estate sales: 2% of the profit

- Prizes, gifts, and inheritance income: 10%

- Franchise, copyright, and royalties income: 5%

Personal Income Tax Deduction

Based on Resolution 954/2020/UBTVQH14 on June 2, 2020, about the Increases in the family circumstance-based deduction for Personal Income Tax, take note of the following:

- Increase Individual Deduction from VND 9 million per month to VND 11 million per month.

- Increase Family Deduction from VND 3,6 million per month to VND 4,4 million per month.

- These increases will reduce the accessible income for PIT treatment.

- These changes are applied for monthly PIT treatment valid from July 1, 2020, and PIT finalization for 2020.

You might want to read: How Do You Calculate Your Foreign Contractor Tax in Vietnam?

Tax-Free Incomes

According to Article 4 of Law on Personal Income Tax, there is a long list of tax-free sources of income in the country. These sources are:

- Income earned from real estate transfers between spouses, blood relatives, and adopted families is tax-free. Income earned from inherited real estate is also tax-free income.

- Income for the remittances that a person earns on the money sent by their foreign relatives, who are in another country to either work or study, is considered Tax Free Income.

- Pensions paid by the social insurance fund are also a source of tax-free income.

Income Tax Exemptions

To make things easier for taxpayers, the government has offered tax exemptions on various income sources. The first income that does not require the taxpayer to remit the tax is their foreign remittance. It may be in the form of educational support payment or some form of a retirement pension. Another income that does not require the worker to pay tax on them is the one that is earned on the night shift of the job. The condition for that is the salary for the overtime must be greater than the regular shift salary.

Related: Tax Reporting Deadlines for 2023 in Vietnam

To attract foreign workers and investors to the country, the government has offered various tax exemptions for foreigners. They include a one-time tax exemption for the person when they move to Vietnam. It helps make the transition of foreigners to the country much easier. If an employer pays for the round-trip airfare for their employee, that amount is exempt from the tax.

There are also various tax exemptions on the amount invested by employers towards their employees. Such as if the employer is responsible for arranging the meal at the lunch break. For an employee’s training session, they do not have to remit any tax to the government against the training fee.

Tax Benefits for Foreigners

In Vietnam, while the definition of taxable income is broad, there are specific benefits and income sources that are exempt from taxation. These non-taxable allowances include:

- Round-trip airfares for expatriate employees or Vietnamese individuals working abroad, once per year.

- School fees (excluding tertiary education) for children of expatriate employees or Vietnamese working abroad.

- Mid-shift meals (with a cap if provided in cash).

- One-time relocation costs for expatriates coming to Vietnam for employment or for Vietnamese working abroad.

- Uniforms (with a cap if provided in cash).

- Benefits are provided collectively (e.g., memberships) where an individual is not the identified beneficiary.

- Allowances or benefits for weddings or funerals.

Related article: Living in Vietnam: 10 Laws Expats Must Know

Deadline for Tax Finalizations

The deadline for paying PIT will be revealed after the tax year concludes, typically following the calendar year. As stated in Article 44, Clause 2 of the 2019 Law on Tax Administration, the submission deadlines for annual tax declarations are as follows:

- Annual tax settlement documents are due on the last day of the third month after the calendar or fiscal year ends.

- Annual tax declaration documents should be submitted by the last day of the first month of the calendar or fiscal year.

- Direct individual tax settlement documents are due on the last day of the fourth month following the calendar year’s end.

- Estimated tax declaration documents for business households or individuals using the estimated method must be submitted by December 15th of the preceding year or within 10 days from the start of business operations for new businesses.

For the tax settlement deadlines for PIT in 2023, they are as follows:

- The latest deadline is March 31, 2024, for organizations and individuals with income from salaries and wages.

- The latest deadline is April 30, 2024, for individuals directly settling taxes on income from salaries and wages with the tax authorities.

About Us

InCorp Vietnam is a leading provider of global market entry services. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,100 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business perfectly fit into the market with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.