Currently the fastest-growing economy in Southeast Asia, Vietnam’s technological prowess and unexplored prospects presents a host of opportunities for foreign investors. Along with the rise of new FinTech companies, there has been a spectacular growth in the wealth management sector in the Asia-Pacific region, especially in Vietnam.

Not sure where to start with company incorporation in Vietnam? Talk to one of our expert business consultants!

While Australia currently has around one-fifth of the Asian-Pacific wealth management market in its grasp, Vietnam will have a Compound Annual Growth Rate (CAGR) of 31.6% by the year 2030, per a projection made by the Allied Market Research. However, unclear rules on pricing and fees across different countries in the region might impede its progress to some extent.

Current status of Vietnam’s Wealth Management market

From humble beginnings, the hermit nation will soon grow into an emerging wealth management top player in the SEA region. Due to years of consistently impressive economic growth and its skilled population of more than 100 million, it can be an asset management star. Current trends in Vietnam, including several regulatory reforms and the rise of the super-rich class, comprising ultra-high-net-worth individuals (UNHWIs), point toward the fact that this economy will soon have the best asset management framework in place.

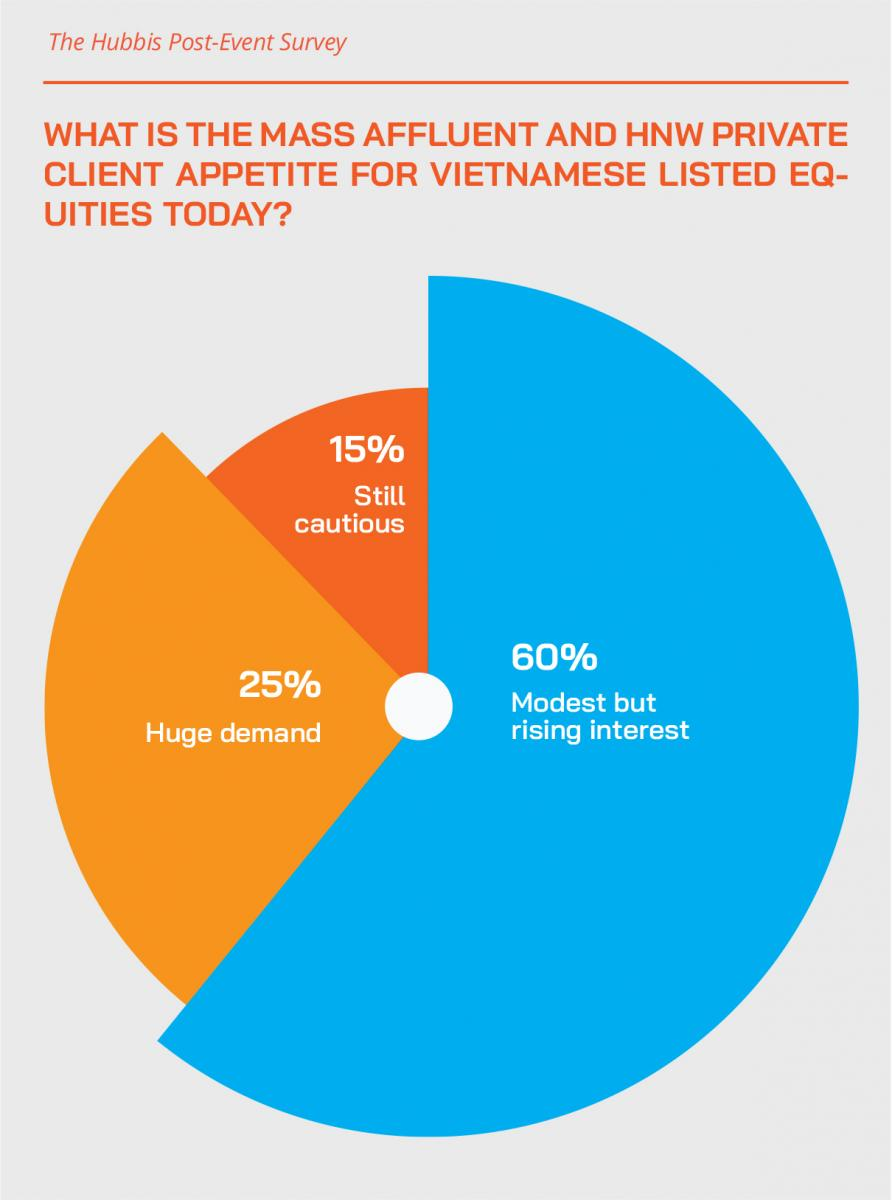

The Helping Asian Wealth Management Communities Interact (HUBBIS) panel members recently made constructive comments on the present status of the Vietnamese wealth management market. Their event article explained that the asset management market needs to follow principles of calculated optimism and practicality as the nation has many years of progress before it can catch up with its neighboring countries. Setting standards, creating a pool of services, and resources and improving customer experience are a few challenges that need strategic solutions for the market to be upscaled successfully.

Opportunities in the Wealth & Asset Management sector in Vietnam

In Vietnam, although there are several important economic measures that are important for the burgeoning of the wealth management sector at the micro and macro levels, various non-economic issues also have to be taken care of.

Its GDP is less than that of its neighbors, Thailand and the Philippines, for the time being. Moreover, in both these neighboring countries, several factors such as lesser rates of interest, higher GDP, reduced unemployment, substantial disposable income, and a strong regulatory ethos have drawn more investors. However, Vietnam has a stable economy with inflation kept under control over the past few years.

According to the estimates released by the World Bank, over 45 million people have overcome the barrier of poverty from 2002 to 2018. Temenos Banking reported that “Vietnam is believed to be home to an estimated 20,000 people with investable assets in excess of $1 million and more than 210 billion USD currently on deposit in plain vanilla cash accounts.” With an export-driven stable economy, rising middle class, and the majority population being young, Vietnam has all the qualities of being a powerful player in the wealth management sector.

Growth of Vietnam’s “Super-rich” class

According to the Knight Frank Wealth Report published in 2022, Vietnamese who have acquired USD 30 million worth of assets will soon exceed 1,500 people. Such personalities are also known as ultra-high-net-worth individuals (UHNWIs).

RELATED: An Investor’s Guide to Vietnam’s Fintech Industry

As Vietnam has emerged as an influential nation in the last two decades, even social mobility is the fastest among the super-rich, the rich, and the middle classes. The report also reveals that in the years between 2020-2025, the growth rate of Vietnamese millionaires will be 32%, and that of the super-rich will be 31%.

As of now, Vietnam has 19,500 millionaires, which might witness a 25% growth by 2025. This prediction will further add to its economic positioning as far as millionaires in the Southeast Asian region are concerned.

Amongst the ASEAN nations, Vietnam holds 6th place on the list of super-millionaires whose worth is more than USD 30 million. Incidentally, it also occupies the 6th position in the Southeast Asian region in the number of billionaires, as reported by Forbes. It has been estimated that this country will have 511 super-rich individuals by 2025.

As for the most recent data, the six billionaires of Vietnam have a total worth of USD 19.5 billion as of 23rd December 2021.

About Us

FinTech is the main component in the evolution of Vietnam’s financial industry.

As the leading business consulting firm in Vietnam, Cekindo thinks immensely about the impact that FinTech in Vietnam will have on diverse businesses and broader aspects in the region. Therefore, we strive to provide you with the latest updates and recommendations.

Our professional consultant team is well placed to help you drive your FinTech business growth. We also serve as a platform for many other types of businesses to access the vast opportunities that FinTech in Vietnam is ready to offer.

Speak to our local experts today. Fill in the form below.