During the COVID-19 pandemic, the digital landscape witnessed a significant transformation, giving rise to numerous online platforms across various industries. In Vietnam, this period marked a surge in growth for unicorn startups, particularly in the online gaming sector, which capitalized on the increased interest in digital entertainment. Market research from RedSeer indicates a notable uptick in online gaming participation across ASEAN countries.

VietnamNet reports that the gaming community has seen a significant surge, with gaming startups increasing from 400 in 2012 to 3,000 in 2017. By 2021, two Vietnamese startups, MoMo and Sky Mavis, joined the ranks of unicorns, following VNG in 2014 and VNLIFE in 2019.

Interested in Startups in Vietnam? Check out InCorp Vietnam’s Incorporation Services

VNG – Technology and Gaming Giant

VNG Corporation is one of the most prominent gaming companies in Vietnam. It produces, develops, and publishes various online games. Along with other South Korean companies, it has invested US$81 million into Haegin. It is a mobile gaming company that owns “Play Together”. This investment helps VNG to expand globally in the metaverse sector, which is all about virtual worlds.

VinaGame, now known as VNG, marked its first milestone in 2005 with the release of Vo Lam Truyen Ky (Swordsman) and attracted 20 million gamers within a decade. This success led to a revenue of US$17 million by 2006. VNG ventured into e-commerce, social media, and digital music and expanded beyond gaming. Recognized as Vietnam’s first unicorn in 2014, VNG’s value soared to US$1.5-1.7 billion by 2020.

It became one of the most closely observed companies, considering a potential initial public offering (IPO) in 2023. The tech firm has applied to trade certain shares on a local exchange for unlisted companies. It is a common strategy to gauge market interest before a formal IPO.

This Vietnamese tech company has expanded into various sectors, notably with Zalo, its messenger app launched in 2012. In 2020, it outpaced Meta’s Facebook Messenger and amassed over 74 million active users. Eyeing international expansion, VNG aims to debut in the US market, as reported by Nikei Asia, amidst global market shifts in 2023.

Ho Chi Minh City has hosted over US$1 billion in startup companies like VNG, revered as the “giant brother” of the startup community. Its owner selected the city for its generosity, dynamism, and adaptability. In 2014, VNG, Vietnam’s inaugural technology unicorn, was valued at US$1 billion. Later, Temasek Holdings valued it at US$2.2 billion, reaffirming its status.

Read Related: 9 Reasons to Choose Ho Chi Minh City in Vietnam to Launch Your Business

VNPay – Fintech

Vietnam’s second tech unicorn, VNLife, owner of cashless payment firm VNPay, announced a US$250 million acquisition by U.S. investors. Having secured US$300 million in 2019 from a U.K.-based investor and Singapore’s GIC, VNPay is now valued at US$1 billion.

With a significant presence in the local Fintech sector, it serves 22 banks and boasts 15 million monthly users who engage in online bill payments, money transfers, and grocery purchases. The company’s co-venture, VNPay-QR, aids 150 retailers and 22 million users, presenting ample opportunities for expanding financial services and leveraging data in a market where 70% lack banking access.

VNLife pioneered SMS banking, encouraging bank partnerships to create a thriving app in business. While banks in China and Indonesia lagged in digitization, it facilitated early digitalization for Vietnamese banks. After receiving the Softbank Vision Fund and GIC funding, VNLife became Vietnam’s second billion-dollar tech company after VNG.

The company plans “meaningfully profitable”, an awareness campaign targeting small sellers for consumer data access and expanding digital banking services to the below-listed countries.

- Cambodia

- Myanmar

- The Philippines

- Indonesia

VNPay is widely embraced across the region, offering users a range of payment options from utility bills to QR-based payments. Serving 40 banks in Vietnam, 12 in Cambodia, and 7 e-wallet providers, VNPay’s network boasts approximately one million settlement points, processing about US$1 billion annually in payment value.

With a projected compound annual growth rate of 30.2% from 2020 to 2027, Vietnam’s mobile payment market is anticipated to reach US$2.7 trillion by 2027. It is showcasing substantial potential for the country’s e-wallet sector. VNPAY, established in 2007, gained early approval from the State Bank of Vietnam for e-wallet services.

In 2022, VNPAY reported impressive net revenue of VND29,937 billion (US$1.2 billion), marking a 35% increase from the previous year. Despite a 94% drop in net profit to VND 19.5 billion (US$803,300) in 2022, VNPAY exhibited an average annual net profit growth of 125.5% from 2019 to 2022.

According to their financial statements, VNPAY’s net profit in 2021 was only behind VNPT Pay with VND 380 billion (US$15.65 million). Notably, four e-wallets that reported losses were Moca (VND 165 billion or US$6.8 million), ShopeePay (VND 385 billion or US$15.86 million), Momo (VND 800 billion or US$32.96 million), and ZaloPay (VND1,200 billion or US$49.4 million).

Read Related: The Remarkable Rise of Vietnam’s Fintech Industry: A Guide for Investors

Mobile Money (MoMo) – Vietnam’s Leading E-Wallet

In the highly competitive tech startup landscape, MoMo has recently ascended to the fourth position in the unicorn startup race, achieving a remarkable valuation of US$2 billion. This milestone was reached through a strategic investment of US$200 million from Japan’s global financial company, Mizuho Bank.

Originating as a humble SIM card application facilitating mobile recharge and money transfers in 2010, MoMo swiftly evolved into a comprehensive e-wallet. It later transformed into a super-app in 2014 and started offering many services, such as

- Donations

- Investments

- Insurance processing.

Its strategic vision involves channeling its funds towards the digitization of the rural market, supporting SMEs, and attracting more tech investments. The ultimate goal is to develop a multipurpose smartphone application that offers diverse financial solutions.

As an e-wallet service startup, it has achieved unicorn status within the e-payment service sector. Established in 2007 by M_Service, MoMo has evolved into a super application, providing users with a versatile platform for payments and transactions across various aspects of life. The company began developing its e-payment ecosystem in 2010, and by March 2016, it boasted 2.5 million users.

As of 2022, MoMo has forged partnerships with over 90% of banks in Vietnam and approximately 10,000 domestic traders. This strategic positioning has solidified its leading market share of over 80% in the digital payment sector, serving a user base surpassing 31 million.

The Series E-fundraising round in 2021, garnering US$200 million in investment, propelled MoMo’s valuation to over US$2 billion. This achievement solidifies its position as one of the country’s three tech unicorns.

In the recent Series E funding round, MoMo has secured an additional US$200 million in investment by attracting global investors such as:

- Mizuho

- Ward Ferry

- Goodwater Capital

- Kora Management.

It has exceeded expectations in just a decade, creating an ecosystem across Vietnam with 50,000 partners, 140,000 payment points, and collaborations with over 70 partners, fulfilling its initial vision. This digital platform caters to Vietnamese people’s essential shopping and payment needs, making MoMo a prominent player in the tech ecosystem.

Sky Mavis – NFT-based Online Game Axie Infinity and the Metaverse

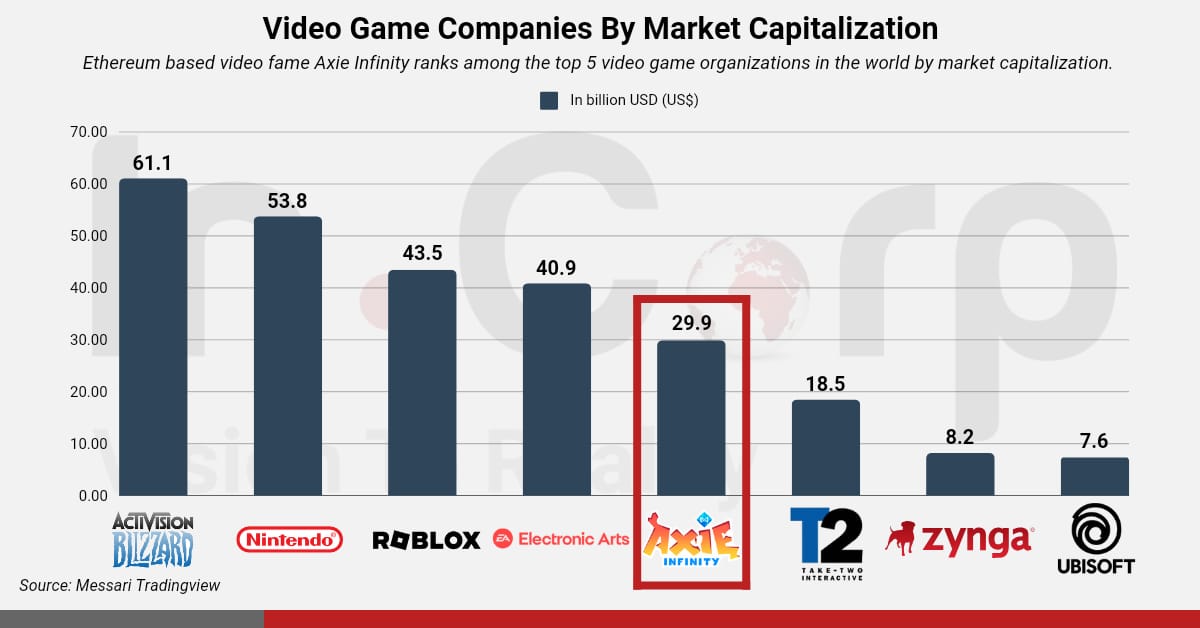

In Vietnam’s burgeoning startup landscape, Axie Infinity, an NFT-based online game by Sky Mavis, has surged ahead, boasting a valuation of US$2.4 billion. This unprecedented success catapults the country, known for its agricultural and textile exports, into the digital currency spotlight.

Across regions like the Philippines, Axie Infinity is a primary income source. Resembling Pokémon, players engage their NFT Axies in battles, making them valuable digital assets. These Non-Fungible Tokens, representing Axies, are tradable within a virtual realm or metaverse.

Founded by Nguyen Thanh Trung in early 2018, Sky Mavis swiftly emerged as a unicorn in the Vietnamese unicorn startup realm, focusing on blockchain-driven online games. Their flagship creation, Axie Infinity, launched in February 2018, has garnered immense popularity, boasting 2.6 million gamers by early 2021.

Expanding its offerings, Sky Mavis is crafting a comprehensive blockchain ecosystem featuring diverse products like e-wallets, a non-fungible token marketplace, and the Kanata decentralized exchange. With a Series B round amassing US$152 million in October 2021, it reached unicorn status in three years and eight months, a remarkable feat compared to industry benchmarks.

Predictions for 2025 and Beyond

As Vietnam embraces the startup boom with increased investment in groundbreaking innovations, the landscape seems poised for the rise of more unicorn startups soon. Highlighted in an analysis by CafeF referencing insights from Forbes Vietnam, a cohort of “near-unicorn” enterprises is poised for accelerated growth.

Noteworthy among these prospects is Tiki, positioned as the third-largest e-commerce platform within Vietnam’s market, alongside Giao hang Tiet Kiem, a swiftly ascending delivery service provider. Trusting Social, which specializes in harnessing big data and machine learning technologies to extend financial services to individuals lacking credit records, and Kyber Network. It facilitates decentralized cryptocurrency exchanges to round out the roster of promising ventures.

Within the Southeast Asian sphere, Vietnam is the third most coveted destination for foreign investors, trailing only Indonesia and Singapore in appeal. Notably, the first six months of 2019 witnessed a staggering US$5.9 billion inflow into Asian startup ventures, with Vietnam securing a 17% share.

The Ministry of Planning and Investment anticipates Vietnam hosting a minimum of five tech unicorns valued at over US$1 billion by 2025. According to their projections, this figure is expected to double by the dawn of 2030.

Guided by insights from the Central Institute for Economic Management (CIEM), achieving the target of ten unicorns by 2030 requires concerted governmental action. This action aims to stimulate robust capital infusion from public and private channels into burgeoning startups.

Crucially, fostering an environment conducive to the evolution of innovative startup investment models stands paramount. This entails leveraging tax incentives and policy frameworks to allure and retain top-tier talent. Thereby nurturing a fertile ecosystem conducive to the sustained proliferation of groundbreaking enterprises.

As Vietnam strives to become a hub for unicorn startups, strategic policy interventions and robust investment frameworks will be crucial. These efforts will shape the trajectory of the entrepreneurial landscape, fostering sustained prosperity and innovation-driven growth.

We made the most detailed step-by-step guide for Company Incorporation in Vietnam for investors, now available as an interactive checklist:

About Us

InCorp Vietnam is a leading market entry and corporate services firm in Vietnam. We are part of InCorp Group, a regional leader in corporate solutions that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,200 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business fit into the market perfectly with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.