Electric vehicles (EVs) are playing a pivotal role in Vietnam’s endeavor to switch to low-carbon fuel solutions. As a result, the country must build the right ecosystem of consumer buy-in, policy support, and infrastructure development to meet these ambitious goals. Moreover, the policies related to the energy sector and Vietnam’s 2050 carbon neutrality goals are closely connected to electric vehicle adoption.

Investing in Vietnam? See Our A-Z Market-entry Services

Electric Vehicles Market in Vietnam

Vietnam’s electric automobile industry is seeing great opportunity for a number of businesses to join its production chain. For example, the VF e34 electric car, manufactured by VinFast, the “Tesla of Vietnam”, is expected to become Vietnam’s most iconic carbon-neutral vehicle. Approximately 25,000 customers have purchased this model, and the manufacturer aims to provide 2,000 cars per month to sales agents by the end of 2022.

In December 2021, the construction of VinES, a battery production facility in Ha Tinh’s Vung Ang Economic Zone (EZ) began in full swing. It is expected that by the end of the next decade, the production plant will be able to manufacture 100,000 battery packs.

The country aspires to be a leading manufacturer of electric vehicles and associated components in the coming future. VAMI (Vietnam Association of Mechanical Industry) submitted a proposal concerning clean-fuel vehicles to the Prime Minister. The association believes that electric vehicle (EV) manufacturing will attract business owners to invest in battery production.

Moreover, following the international trend, Vietnam can develop a clean-fuel automobile industry which can eventually aid in creating a cleaner method of transportation, reducing pollution.

As part of the Vietnam Electric Vehicle Industry Development Plan, VAMI has proposed specific goals: by 2035, all vehicles registered in Vietnam would use clean fuel, and from that year, all vehicles in Vietnam would be electric.

The document stated that the members of VAMI, mechanical engineering manufacturers, want to become a part of the EV manufacturing chain in Vietnam as it is a fast-developing country.

Moreover, various proposals for the upliftment of the Electric Vehicles manufacturing industry were introduced in 2021. Vingroup suggested the Government apply preferential rates on luxury tax and vehicle registration tax for 5 years. EV buyers and manufacturers would benefit from preferential taxes offered by the Vietnam Automobile Manufacturers’ Association (VAMA) in 2021-2030.

RELATED READING: A Comprehensive Guide to Green Energy Growth & Investment Opportunities in Vietnam

Following consultations with the relevant ministries and agencies, the Ministry of Finance (MOF) proposed an exemption of registration taxes for 3 years and a 50% reduction for two years.

According to Vietnamnet, to curb the luxury tax on EVs, the Vietnamese Government has proposed a plan that will reduce it by 5-12% over the next 5 years, from the prevailing 15%. A number of policies encourage the development of EVs: preferential treatment for manufacturers, subsidies for buyers, and infrastructure development and administrative support.

Electronic Vehicle adoption in Vietnam

According to a report by 6Wresearch, the Vietnam Electric Vehicle Market can be divided into vehicle types, charger types, DC charger power levels, and charger-end-consumers.

Approximately 95% of the overall electric vehicle market volume came from the two-wheeler segment in 2019. Three-wheelers followed closely in terms of market volume.

Electric buses are expected to register high growth rates during the years 2020-2025 thanks to the government’s proactive steps in developing and deploying clean public transportation and electric buses.

Have you heard our podcast yet?

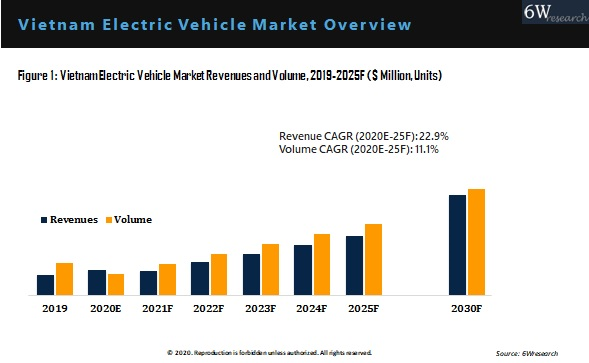

The electric vehicle market size in Vietnam increased at a CAGR of 22.9% from 2020 to 2025, according to 6Wresearch. However, the country’s low levels of GDP per capita (USD 2300) hinders the adoption of electric four-wheelers. Moreover, consumers are also less likely to adopt electric vehicles due to a lack of proper charging infrastructure.

Vinfast, a local company, however, plans to introduce low cost electric vehicles along with the installation of adequate charging stations over the coming years, which will lead to a healthy increase in the use of electric vehicles.

EV Market: Major Challenges

In order to develop electric vehicles in Vietnam, the government must address three major challenges – increasing energy consumption, inadequate infrastructure, and excessive costs.

Infrastructure: Due to inadequate transportation infrastructure in Vietnam, the government should be focused on implementing supportive policies giving priority to plug-in hybrid electric vehicles. This will enable a seamless transition to battery-operated electric vehicles.

Power Consumption: The total power demand coming from the transport sector will be nearly 4 billion kWh by 2030 if electric motorbikes and cars account for 34% and 30% of total sales, respectively. Hence, it is imperative for the government to ramp up the supply of power in the country.

Manufacturing Cost: Vietnam has only a few policies promoting the development of electric motorbikes and cars, making them more expensive than fossil-fuel-powered ones. As estimated by the Vietnam Automobile Manufacturers Association (VAMA), EV manufacture will cost 45% more than internal combustion engines by 2020. Electric vehicles are projected to become cheaper by 2030, although they will remain 9-10% more expensive than gas-powered cars and diesel-powered cars.

It is essential to offer attractive tax schemes for the first 10 years so that demand is stimulated, as well as policies that support the development of charging stations. After 2050, these incentives might no longer be needed when electric vehicles have a certain share of the market.

EV Market in Vietnam: The Way Ahead

VinFast is not the only automaker planning to introduce new electric cars to the domestic market in 2022. Other brands are also planning to do so. The foreign automobile manufacturers, including Mercedes-Benz, Toyota, Volvo, and Tesla, have launched or are planning to introduce hybrid and electric car lines to accelerate the transition to an electrified future in Vietnam.

Foreign-invested firms such as Mitsubishi Vietnam and Porsche Vietnam have created battery charging stations to service the distribution of electric vehicles. Between 2030 and 2040, the local automotive industry aims to produce about one million vehicles, including electric cars.