The Vietnamese health product market is highly impacted by Foreign brands due to the limited availability and diversity of locally produced items. The healthcare industry in Vietnam started to flourish in the 1990s, primarily by importing goods from the United States, China, South Korea, and Belgium. The sector has seen notable yearly growth due to heightened consumer demand for health and personal care goods.

The country’s healthcare market presents promising opportunities with an influx of foreign companies, rising income levels, steady economic expansion, and favorable demographic shifts. Despite economic fluctuations, the healthcare sector remains resilient, ranking the country as the second-largest medicine market in Southeast Asia. In 2018, its value was estimated at US$17.4 billion. The COVID-19 pandemic has further emphasized the importance of healthcare, encouraging increased investment and innovation.

Investing in Vietnam Healthcare Industry? Check out InCorp Vietnam’s Incorporation Services

Overview of the Healthcare Industry in Vietnam

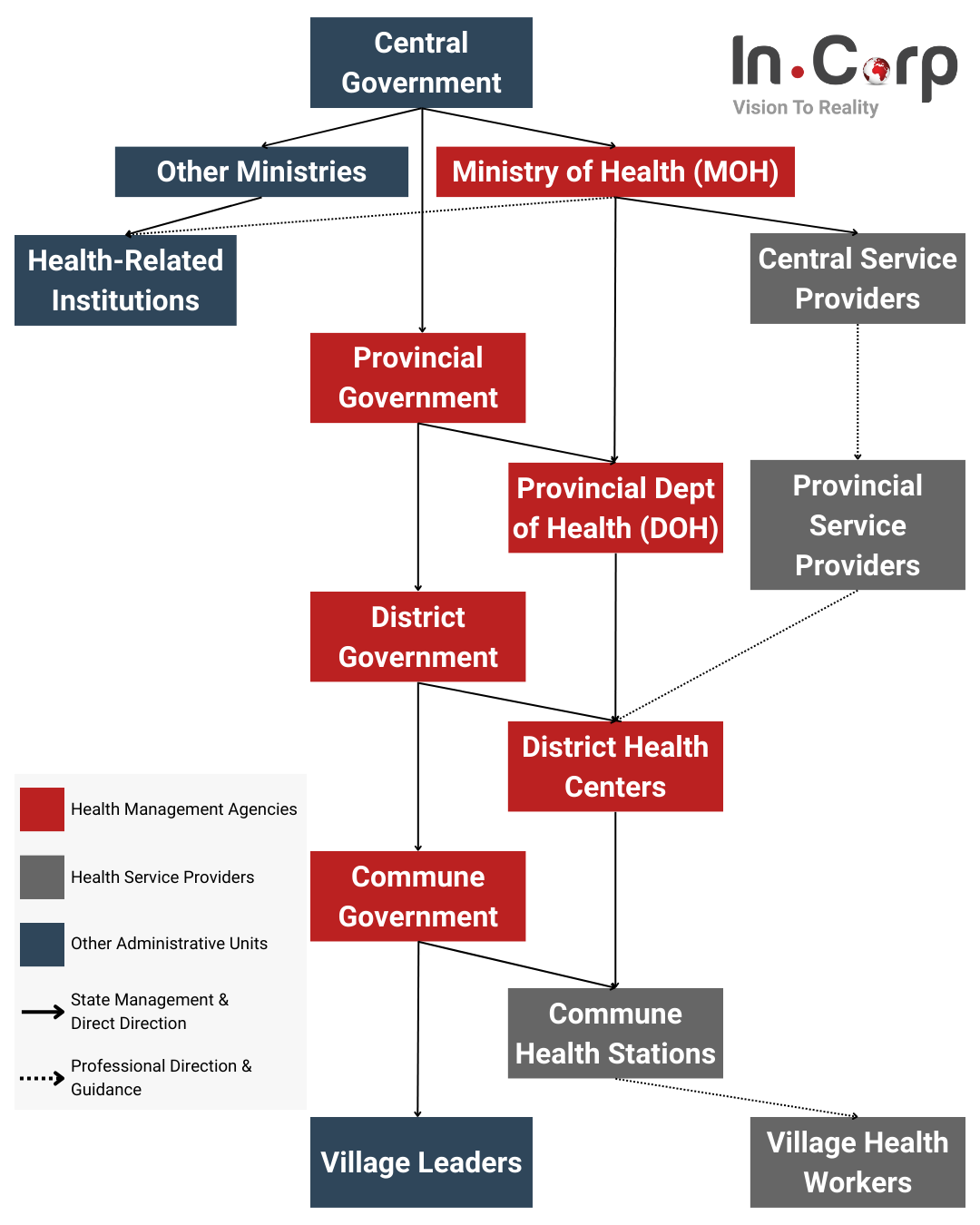

Vietnam has structured a hierarchical healthcare system that extends from regional and rural areas to nationwide. Over the past 3 decades, the country has expanded universal health insurance coverage and reduced healthcare spending. This dedication is apparent in the nation’s focus on preventive medicine and healthcare promotion.

Healthcare System in Vietnam

The health system operates across four administrative levels: central, provincial, district, and commune. Policy-making typically originates from the central level, with the MOH spearheading evidence-based agendas. Approved policies are executed by the MOH and local authorities, monitored by relevant departments, and overseen by the Social Affairs Committee of the National Assembly.

- National Level: The Ministry of Health (MoH) administers the healthcare sector, managing a network of hospitals, research, and academic institutions, with other ministries operating their hospital systems.

- Provincial Level: Provinces and central-affiliated cities run several hospitals, medical centers, and medical colleges with programs in medicine, nursing, and pharmacy.

- District Level: District health centers provide medical and preventative care services.

- Commune Level: Commune health stations are dedicated to primary healthcare services for local communities

Vietnam’s Healthcare Evolution: Rising Economy Fuels Sector Growth

The journey of this country from one of the world’s poorest countries to a lower-middle-income nation showcases a remarkable economic transformation. With a GDP per capita of US$4,086 in 2022, the country ranked as the fifth-largest economy in Southeast Asia and 37th globally, with a GDP of US$406.45 billion. The burgeoning middle and affluent classes, expected to represent 20% of the population by 2030, drive the demand for high-quality healthcare services. It will foster significant developments in the healthcare sector.

According to the Economist Intelligence Unit (EIU), Vietnam’s healthcare expenditure reached approximately US$18.5 billion in 2022, which was 4.6% of the country’s GDP. Demographic changes, such as an aging population and decreasing birth rates, drive the increasing demand for healthcare services. Additionally, the burden of non-communicable diseases (NCDs), accounting for around 74% of total deaths, further contributes to the rising demand.

Private healthcare expenditures are anticipated to expand at a CAGR of 7.5%, mainly due to the growing accessibility of insurance coverage for citizens. Moreover, the healthcare market is evenly split between the private and state sectors, with the private sector accounting for 49.5% of total spending on health.

The healthcare market in Vietnam is projected to grow substantially, with forecasts indicating an increase from US$331.8 million in 2022 to US$2486.65 million by 2030, driven by the adoption of connected healthcare solutions and digital technologies. The COVID-19 pandemic has accelerated the adoption of telemedicine and digital health solutions, which are important for healthcare efficiency and resilience.

High Demand for Foreign Medical Staff

In Vietnam, there is a growing trend of hiring foreign medical doctors due to disparities in healthcare distribution. Only 30% of the population resides in cities. Most medical professionals are interested in serving the urban areas, which leaves the rural regions underserved. Additionally, government hospital doctors receive low pay and often switch between public and private sectors, hindering skill development.

Despite the demand for physicians, expanding the local workforce is challenging due to lengthy training requirements. Consequently, this country increasingly relies on foreign doctors to address healthcare gaps, emphasizing the importance of balancing local talent development with international expertise.

Medical Equipment in the Vietnam Healthcare Market

Due to the limitations in local production, Vietnam encourages importing medical equipment, with some items benefiting from low import tariffs and no quota restrictions. However, the Ministry of Health (MOH) regulates and licenses all medical devices.

Over 90% of medical equipment in Vietnam was imported, with the market valued at US$1.5 billion in 2022. It is projected to grow at a 9.7% CAGR from 2021 to 2026. The MOH oversees state management of medical devices, including legislative implementation, inspections, and resolving complaints.

Decree No. 07/2023/ND-CP extends existing import licenses to December 31, 2024, while Circular No. 14/2023/TT-BYT outlines tender pricing methodologies. The market comprises government-funded hospitals, foreign-owned facilities, and local private hospitals, with research and educational institutions exploring new technologies.

Vietnam allocates public funds for hospital upgrades, supplemented by international aid. While the country is emerging as a manufacturing hub, over 90% of medical equipment is imported, dominated by key players like Stryker Corporation and GE Healthcare. Additionally, diagnostic imaging equipment, surgical tools, and medical waste treatment equipment constitute the bulk of imports from foreign countries.

Interested in Medical Equipment in the Vietnam Healthcare Market? Check out InCorp Vietnam’s Medical Devices Registration Services

Pharmaceuticals in the Vietnam Healthcare Market

The pharmaceutical sector of this country has grown significantly due to high economic development, increasing incomes, urbanization, and an aging population. Business Monitor International has projected healthcare spending to surge to US$23 billion by 2022, up from US$17 billion in 2019. With a compound annual growth rate (CAGR) of around 10.7%, healthcare and pharmaceuticals rank among Vietnam’s top investment sectors. The pharmaceutical market was valued at US$6.7 billion in 2022 and is expected to reach US$8.9 billion by 2026 with a 7.3% CAGR.

The 2016 Law on Pharmacy governs the sector overseen by the Drug Administration of Vietnam (DAV). Decree No. 54/2017/ND-CP provides detailed guidelines covering pharmacy practice, drug import-export, and advertising regulations. Decree No. 155/2018/ND-CP allows foreign companies to establish foreign investment enterprises.

Circular No. 08/2022/TT-BYT, effective from October 20, 2022, amends pharmaceutical product certification requirements to align with international standards. Imports dominate Vietnam’s medical equipment market, mainly from Korea, China, Japan, the US, and Germany. Domestic production mainly covers basic medical supplies, with limited warranties and after-sales services.

Vietnam’s pharmaceutical market surged from US$5 billion in 2015 to around US$10 billion in 2020. IBM forecasts it to hit US$16.1 billion by 2026. IQVIA noted a 2% year-on-year growth, which resulted in a 6% CAGR from 2018 to 2020.

Health Supplement Registration in Vietnam

The Vietnam Food Administration (VFA) oversees health supplements and food products, operating under the Ministry of Health (MoH). VFA approves investor registrations for selling health supplements and issues relevant regulations. In February 2018, VFA released updated guidance on implementing specific articles of the Food Safety Law and outlined food safety audits and inspection duties for agencies.

In Vietnam, food products fall under the regulatory purview of three ministries:

- The Ministry of Health (MOH).

- The Ministry of Agriculture and Rural Development (MARD).

- The Ministry of Industry and Trade (MOIT).

Decree No. 38/2012/ND-CP guides these ministries in implementing provisions of the Food Safety Laws. Health supplements, produced in various forms, witness increased imports, reflecting a growing demand.

According to the country’s regulations, manufacturers must submit announcements or specifications for food safety compliance to the Vietnam Food Administration or the Department of Health. As outlined in the Food Safety Laws, the imported foods undergo inspection as per the below categorization:

- Common Inspection

- Tightened Inspection

- Simplified Inspection

Health Supplement in Vietnam: Definition

Food encompasses items that humans consume for nourishment and enjoyment, regardless of their form—fresh, raw, processed, or preserved. Notably, medical products, tobacco, and cosmetics fall outside this definition. Various sub-categories exist, including nutritional, genetically modified (GMOs), fresh, functional, irradiated, and packaged foods.

Functional food, notably health supplements, aims to bolster bodily functions and minimize pathogenic risks. In Vietnam, health supplements are regulated under functional food, serving as dietary additions to enhance bodily functions and mitigate disease risks. These supplements may contain vitamins, minerals, amino acids, and other biologically active substances derived from animals, minerals, or plants. They come in diverse forms, such as soft gels, pellets, tablets, or liquids, facilitating easy consumption.

How Do You Register for a Health Supplement in Vietnam?

There are some specified requirements associated with the registration process. You must adhere to those requirements to register your health supplements in this country.

- Eligibility Assessment: Before commencing registration procedures, companies must verify that their product aligns with Vietnam’s regulations and meets the criteria for registration.

- Product Testing: Thorough laboratory testing is frequently necessary to confirm the product’s safety, quality, and effectiveness. This encompasses examinations for microbiological contamination, heavy metal content, and the concentration of active ingredients.

- Product Labelling: Besides general regulations, the following are the main requirements for promoting health supplements in this country:

+ Name of the Product

+ Ingredients

+ Dosage

+ Health Claims

+ Instructions to Store

+ Expiry date

+ Manufacturer Information

+Barcode

- Safety and Hygiene: Meeting health, safety, and sanitization standards are essential to obtain licensing in Vietnam. The Certificate on Satisfaction of Standards on Food Hygiene and Safety is mandatory for companies and product owners. Hygienic Environmental Requirements dictate the regular upkeep of structures used for manufacturing and selling goods. Every employee involved in health goods, including the company owner, must undergo health exams regularly to align with Ministry of Health standards. Training certificates are also required to ensure a comprehensive understanding of food safety and hygiene policies.

- Dossier Application: The registration dossier, which comprehensively outlines the safety and quality data of the product, must adhere to the country’s regulations. This stage is critical because any inconsistencies or incomplete details could result in delays or rejection.

- Submission to VFSA (Vietnam Food Safety Authority): The dossier is presented to the VFSA for examination and assessment. This phase could span several months, during which the VFSA scrutinizes the product’s safety and effectiveness.

- Approval and Registration: Once the VFSA completes a successful evaluation, it approves, and the product becomes officially registered.

- Post-Market Surveillance: After registration, businesses must maintain vigilance by monitoring their products in the market to ensure consistent adherence to safety and quality standards.

The health supplement licensing procedure typically requires 4 weeks from document submission. The Ministry of Health-issued record must specify an expiration date once approved.

For overseas health products, the following documentation is necessary:

- Declaration form

- Documents validating consumer safety or permitting free sale in the country of origin or exportation, including certificates of free sale, exportation certificates, and health certificates (legalization through the consular process is required).

- Duplicate of a laboratory report originally approved and issued within one year of the product’s food safety application by an ISO 17025-compliant or certified laboratory.

- Scientific evidence demonstrating the effects of a drug or component (original or authenticated copy). If the effects of the ingredients are supported by scientific research, the daily dose of those ingredients must be higher than or equivalent to 15% of their stated value.

- Certificate for Good Manufacturing Practice (GMP) or equivalent documentation.

Check out InCorp Vietnam’s Health Supplement Registration Services in Vietnam

Challenges and Issues for Investors in the Healthcare Industry in Vietnam

Below are some factors that are expected to limit the growth of the connected healthcare market in Vietnam.

A Multifaceted Healthcare Workforce

Vietnam benefits from a diverse and dedicated healthcare workforce. It includes doctors, nurses, pharmacists, laboratory technicians, and other medical professionals. Each member plays a distinct role in providing top-tier care to the population, collectively serving as the foundation of the nation’s healthcare sector.

Challenges in Workforce Training and Retention

The journey of building and sustaining this healthcare workforce faces hurdles. The training and retention of medical staff pose distinct challenges and opportunities.

- Brain Drain: Skilled healthcare professionals emigrating for better opportunities abroad contribute to talent shortages domestically, impacting care quality.

- Training Opportunities: Ensuring a steady supply of well-trained medical professionals demands an emphasis on education and skill development.

- Motivation and Retention: Sustaining a motivated workforce requires adequate compensation, career advancement opportunities, and a supportive work environment.

International Medical Practitioners

Foreign medical practitioners play a vital role in Vietnam’s healthcare system to enhance the local workforce. These experts bring specialized skills and knowledge that contribute to advanced medical practices and research. Their presence enriches the sector with diversity and expertise. However, collaborations with foreign medical institutions and international organizations facilitate knowledge exchange.

Integrating Local and Foreign Contributors

Foreign doctors bring the necessary skills, but finding the right balance with our local doctors is essential. It is necessary to focus on training and helping doctors grow. This way, Vietnam’s healthcare system can keep improving, and the doctors will better understand the needs of our community.

Market Restraints

In Vietnam, certain regulatory obstacles, especially regarding data privacy and security, still need to be addressed. This complexity can pose challenges to the implementation of connected healthcare solutions that depend on sensitive patient data.

While knowledge about connected healthcare solutions is growing, a significant portion of the population remains unaware of this technology. This lack of awareness could restrict adoption rates and slow down market expansion.

Even with widespread smartphone use, certain areas in Vietnam may face limited internet access. This limitation can pose challenges in consistently providing connected healthcare services, particularly in rural areas.

Read More: Top 10 Challenges of Doing Business in Vietnam: Notes and Advice for Foreign Investors

Role of InCorp Vietnam in Food Supplements Registration Service

InCorp Vietnam plays a crucial role in navigating complex regulations and ensuring successful market entry for the Food Supplements Registration Service. It is an English-speaking law firm offering indispensable expertise and support throughout registration.

- Risk Identification and Mitigation: It helps identify and mitigate potential risks associated with food supplement registration. Our experts assist in navigating compliance issues, potential delays, and rejection, ensuring a smoother registration and market entry.

- Documentation and Dossier Preparation: InCorp Vietnam aids businesses in compiling comprehensive and accurate registration dossiers. It ensures that all documentation aligns with regulations and standards.

- Communication with Authorities: InCorp Vietnam is an intermediary between businesses and regulatory authorities like the VFSA. Our experts establish effective communication channels, liaising with authorities on behalf of the industry to streamline processes and expedite approvals.

- Post-Registration Support: Even after successful registration, InCorp Vietnam provides ongoing support to ensure compliance and address any legal issues that may arise. They offer monitoring services and legal assistance to safeguard businesses against regulatory challenges.

Partnering with us can empower businesses to capitalize on the substantial rewards of Vietnam’s food supplement market while mitigating regulatory risks. With experts’ guidance, companies can confidently navigate the complexities of registration, ensuring successful market entry and long-term compliance in this promising sector.

Some Legal Resources

Below, we have listed some essential resources that you must check to understand the healthcare industry in Vietnam properly.

For Medical Devices:

- Decree 07/2023/ND-CP amends Decree 98/2021/ND-CP dated November 08, 2021, prescribing medical device management.

- Decree 98/2021/ND-CP on medical devices management

- Circular 14/2023/TT-BYT outlines procedures for determining budget limits for procuring goods and services related to medical equipment at public health facilities.

For Pharmaceuticals:

- Law No. 105/2016/QH13: Pharmacy law

- Decree 54/2017/ND-CP: Guidelines for Pharmacy Law Implementation

- Decree 155/2018/ND-CP: It introduces amendments to specific articles related to business conditions under the Ministry of Health Management.

- Cir 08/2022/TT-BYT: It governs the registration of drugs and drug ingredients.

About Us

InCorp Vietnam is a leading market entry and corporate services firm in Vietnam. We are part of InCorp Group, a regional leader in corporate solutions that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,200 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business fit into the market perfectly with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.