Keeping up to date with the latest payroll obligations is a key element in running your business operations smoothly and compliantly in Vietnam. However as with any emerging marketing, with the pains of growth comes regular updates to the legal system, including that of payroll obligations, insurance, minimum wage, and more.

Latest payroll updates to be aware of:

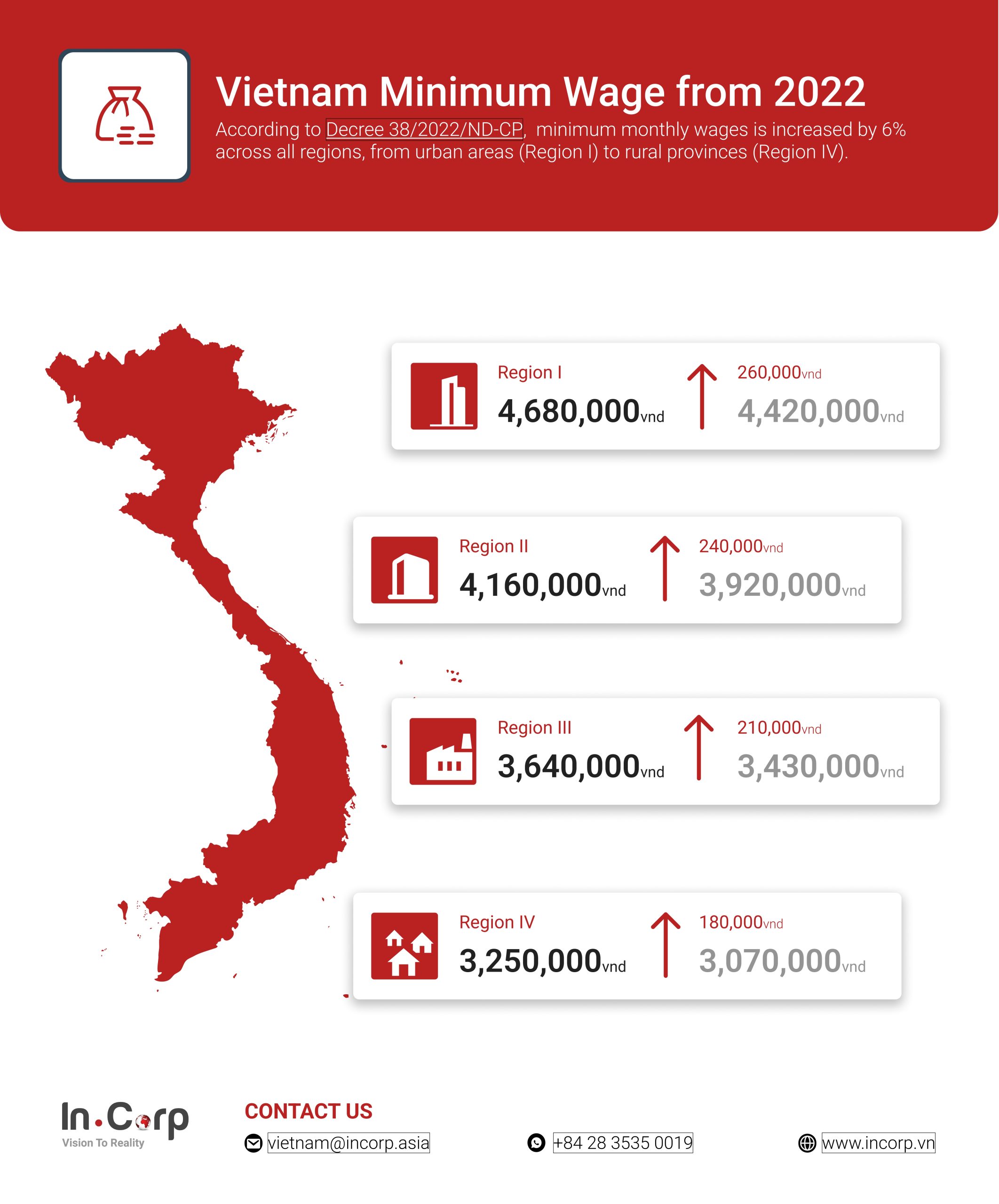

2022 Minimum Wage Update

Based on the latest updates enacted in 2022, the new minimum wage is 4,680,000VND which is applicable in Vietnam’s largest urban areas like Ho Chi Minh City, Danang, and Hanoi. An extra 7% will be added on top for those deemed “skilled workers” with diplomas and other certificates.

Latest Social Insurance Contribution Rates

As of January 2022, the contribution to social insurance is as follows:

- 8%, contributed by the employee

- 17%, contributed by the employee

Find Out About Cekindo’s Payroll Outsourcing Services in Vietnam

What are the Changes in Payroll in Vietnam?

1. Foreign Employee’s Social Insurance in Vietnam

Three categories of employee insurance are listed under the local labor laws:

- Health insurance

- Social Insurance

- Unemployment Insurance

However, from January 1, 2018, all foreign workers and expatriates will be eligible for social insurance contributions, regulated by the 2014 Social Insurance Law. According to Decree 44/2017/ND-CP and Decision, 595/QD-BHXH issued on April 14, 2017, the social insurance payments are only applicable to foreign employees hired in Vietnam with a work permit.

In addition, the Vietnamese government further strengthened the regulation by making social insurance contributions from employers compulsory effective from December 1, 2018.

As of 2021, the law stipulates that businesses in Vietnam must make a contribution of 17%, while employees must contribute 8% for social insurance. Based on the employee’s gross pay, the deduction is made.

Related article: Top Reasons for Payroll Outsourcing in Vietnam

Compensation Benefits

The change of social insurance law also brings foreign nationals the same benefits as local employees, including compensations for occupational diseases, maternity leave, sick leave, and accidents.

Additionally, international employees will get a one-time pension payout when they depart Vietnam. However, foreign employees are not eligible for unemployment insurance benefits.

Eligibility

Social insurance contributions from employers only apply to foreign employees that meet the following conditions:

- an employment contract for a minimum of one year

- a work permit, or a practicing license/certificate

Even if they meet the aforementioned requirements, foreign employees will not be eligible for the social insurance (SI) system in the following situations:

- transferred to Vietnam from an overseas company and the transfer is done internally

- In retirement age as set in Vietnam — 55 and 8 months for women; 60 and 6 months for men

Furthermore, the social insurance payment is only made to the first employment contract, if a foreign employee has more than one employer in Vietnam at the same time. However, all employers of that foreign employees are responsible for occupational diseases insurance and labor accident insurance which is only 0.5%.

2. Employment Tax & Insurance in Vietnam

Regarding Your Local Employees

The following information pertains to payroll taxes in Vietnam for local workers.:

- Personal Income Tax Rate: 5-35%

- Trade Union Fee: 1%

- Contributions to Social Security

- Social Insurance: 8% (paid by employee); 17% (paid by the employer)

- Health Insurance: 1.5% (paid by the employee); 3% (paid by the employer)

- Contribution Unemployment Insurance: 1% from both the employee and employer

Regarding Your Foreign Employees

According to the new law, which will go into effect on January 1, 2022, payroll taxes for foreign workers in Vietnam are:

- Personal Income Tax: Starts at 5 and goes up to 35% (for registered residents); 20% (for non-residents without a TRC). For details, see table below.

Starting from January 1, 2022, certain taxes for foreign employees are adjusted to the following percentages:

- Social Insurance: 8% (contributed by employee); 17% (contributed by employer)

- Health Insurance: 3% (employee); 1.5% (employer)

- Total (until end of June 30, 2022): 29.5%

*Starting from July 1st 2022 the total will increase to 30%

Death and retirement benefits for foreign employees came into force at the beginning of January 2022.

Personal Income Tax (PIT)

All resident taxpayers’ personal income tax rates in Vietnam range from 5 to 35%. (this applies to both locals and foreigners). The tax deduction percentage depending on monthly taxable income is further detailed in the table below.

| Tax Rate | Monthly Taxable Income (VND) |

| 5% | < 5,000,000 |

| 10% | 5,000,001 – 10,000,000 |

| 15% | 10,000,001 – 18,000,000 |

| 20% | 18,000,001 – 32,000,000 |

| 25% | 32,000,001 – 52,000,000 |

| 30% | 52,000,001 – 80,000,000 |

| 35% | > 80,000,001 |

Related article: Your Simple Guide to Payroll in Vietnam: Compensation, Benefits and Bonuses

3. Latest Increase in Minimum Wage

July 2022 Update: The current minimum wage is 4,680,000VND which is applicable in Vietnam’s largest urban areas like Ho Chi Minh City, Danang, and Hanoi. An extra 7% will be added on top for those deemed “skilled workers” with diplomas and other certificates.

The full guide to minimum wage updates for Vietnam, across all regions is available here:

About Us

InCorp Vietnam is a leading provider of global market entry services. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,100 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business perfectly fit into the market with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.