By 2030, Vietnam is expected to achieve significant economic milestones within Southeast Asia, as predicted by the World Bank. In order to promote lower tariffs and reduce trade barriers, it has already signed a number of free trade agreements (FTAs). Moreover, the rise of the fintech industry and the booming e-commerce sector ensures that the country is on a path to becoming a strong digital economy. The combination of all these factors reaffirms that now is the best time for investment in Vietnam.

As a result, investors from all around the world looking for investment opportunities in Southeast Asia or Asia-Pacific have increasingly been setting their eyes on the country. From 2023 onwards, Vietnam is ready to see a tremendous inflow of foreign investments.

Investment in Vietnam? Check Out InCorp’s Market Entry and Business Setup Services

Factors Contributing to Vietnam’s Economic Growth

1. Investing in Sustainability

The Vietnamese government understands the urgency to switch to green energy and has set a carbon-neutral target for 2050. In fact, as of 2020, the nation had the largest solar power output in Southeast Asia. Moreover, it is ranked among the best ten nations in the world for producing solar power.

Related: Vietnam is Ready to Implement Carbon Pricing for Sustainability Goals

To realize its goal of carbon neutrality, it is imperative that Vietnam proactively invests in solar and wind power production by 2030. Various measures like carbon pricing and Emission Trading System (ETS) have also been considered by the government to combat climate change. Moreover, international companies have now got access to Vietnam’s previously uncharted wind energy sector.

2. A Young Working Population

Vietnam’s labor market reflects a demographic that is quite young, with a sizable share of the workforce falling between the ages of 25 and 54. In 2023, the workforce in Vietnam will be 32.5 years old on average.

Additionally, there are clear patterns in the distribution of gender and age in the Vietnamese labor market. Approximately 48% of the working force is made up of women, who represent a sizable share of the workforce. Through a number of legislation and initiatives, efforts are being made to advance gender equality and empower women in the workforce.

Related: Characteristics of Vietnam’s Workforce: High Demand Skills in 2023

3. Government tax incentives

There are two main incentives for corporate income tax (CIT) in Vietnam, namely preferential tax rates and tax holidays. Businesses can also cut costs by taking advantage of leasing exemptions and customs tariff rewards.

Tax incentives in Vietnam are among the most lucrative in Southeast Asia, giving foreigners a favorable environment to expand their business operations or invest. For instance, a company can be eligible to pay no taxes in the first years if they are involved in a tech-based sector or have their establishment based in special economic zones.

Moreover, government resolution 406 was passed in December 2021 as an aid to companies affected by COVID-19.

4. Strategic Location

Due to its central location in Southeast Asia, Vietnam is an attractive investment destination. The country shares shipping routes with China in addition to its proximity to the country. It also has nearly 50 active freight ports and 10 international airports.

Vietnam’s capital city is in the north, Hanoi, while its financial center in the southern region, Ho Chi Minh City, is home to a melting pot of startup activity. Moreover, a number of business opportunities can be found in Da Nang, the country’s second-largest city.

5. Significant trade agreements

Investment in Vietnam is easier than ever thanks to a multitude of trade agreements. These trade deals provide convenience to investors from around the globe by enabling them to establish businesses owing to reduced trade barriers and cheaper tariffs.

6. A Stable Political and Economic Environment

By 2025, the government plans to transform the country into a mid-income nation, an upper-income nation by 2030, and a high-income nation by 2045. In order to accomplish this goal, steady economic progress is needed. Vietnam’s economy grew by 7% in 2019 in spite of the COVID-19 pandemic, clocking USD 271.16 billion in GDP (2020). According to Trading Economics forecasts, the country’s GDP will average around 340 USD billion in 2023.

7. Relocation of Supply Chains from China

With the prevalence of US and China trade disputes, Vietnam stands to gain the most. Companies in China looking to divert their production are inclined towards entering Vietnam.

8. A Stable & Industrialized Future

By 2030, Vietnam is expected to be one of ASEAN’s top three industrialized countries. Several of its industries are competitive at a global level and are an integral part of the global value chain. The national industrial development policy aims to achieve ultimate modernization and industrialization by 2045 in Vietnam.

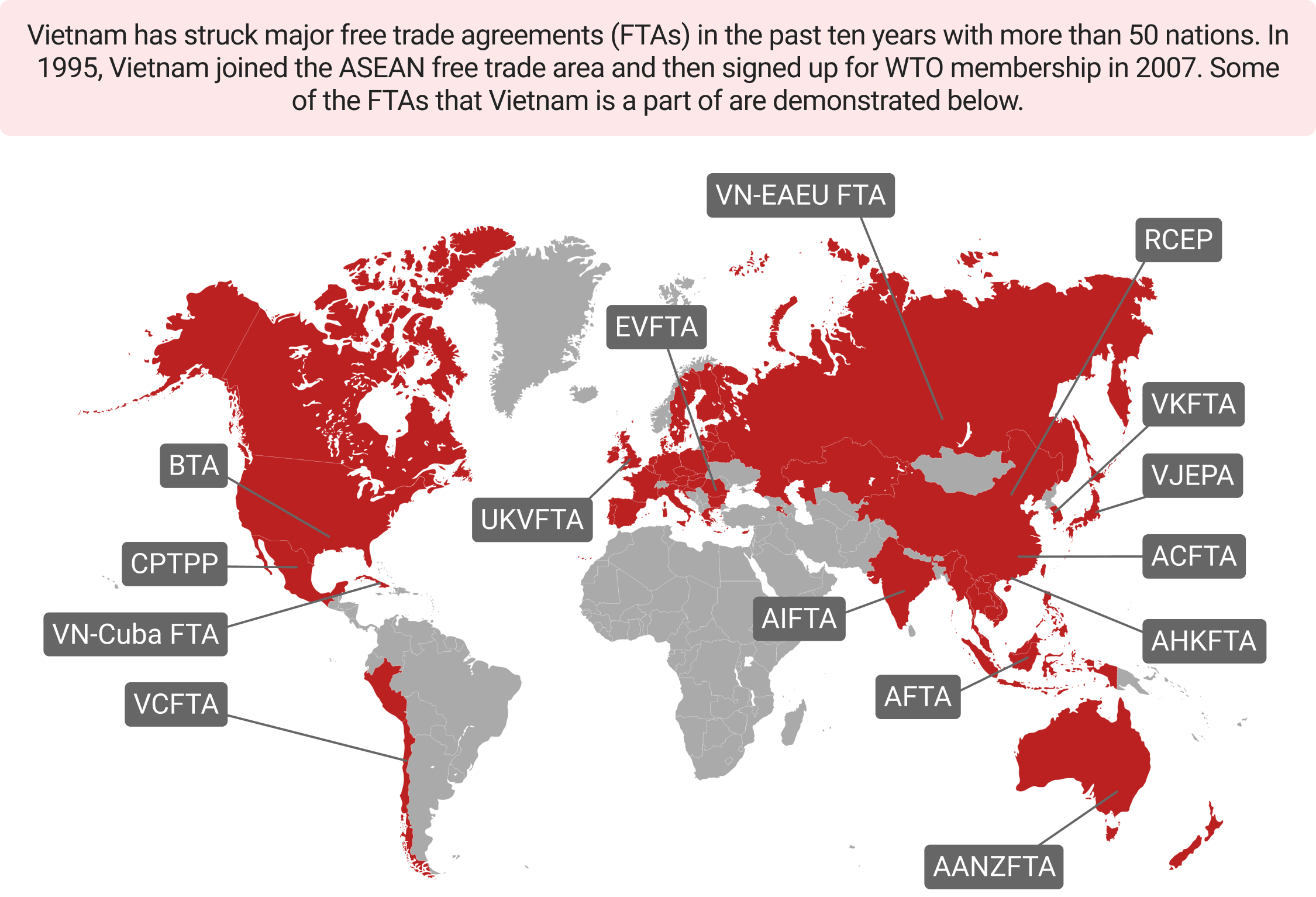

Free Trade Agreements

By investing in public projects and supporting foreign investment, Vietnam has welcomed free trade with much optimism. Moreover, the country successfully fused globalization with national policy that made it easier to trade and let healthy competition flourish.

Related: All of Vietnam’s 14 Free Trade Agreements and Their Implications

Vietnam has struck major free trade agreements in the past ten years with more than 50 nations. In 1995, Vietnam joined the ASEAN free trade area and then signed up for WTO membership in 2007. Some of the Trade Agreements (FTAs) that Vietnam is a part of are as follows:

- EU-Vietnam Free Trade Agreement

- Vietnam & the Trans-Pacific Partnership (CPTPP) – Trans-Pacific Trade

- Vietnam-UK Free Trade Agreement

- The U.S.-Vietnam Bilateral Trade Agreement (BTA)

- ASEAN – Regional Free trade agreement

- Vietnam and China Free Trade under ASEAN

- Trade between Vietnam and Australia/New Zealand under AAFTA-ASEAN

- Vietnam – South Korea Free Trade Agreement (VKFTA)

- Vietnam- Japan Economic Partnership Agreement (VJEPA)

- Vietnam and India under ASEAN (AIFTA)

- Vietnam – Eurasian Free Trade Agreement

- RCEP, the largest trade deal initiated by China

- Vietnam – Cuba Trade Agreement

- Vietnam-Chile Free Trade Agreement

Economic Data for 2030 & Beyond

According to the projections, the country’s GDP is going to grow at a rate of 10.26% by 2026. With the global economy recovering from the aftermath of the pandemic, Vietnam has shown significant progress and risen to the status of a middle-income country.

Related: Vietnam’s Promising Growth Prospects for the Coming Decade

The government’s current five-year development plan (2021-2025) is aimed at the seamless implementation of the present economic development framework. Moreover, Vietnam’s robust manufacturing, an integral part of the global supply chain, provides opportunities to diversify exports and foster trade partnerships.

Vietnamese officials are aiming for the country’s high-income status by 2045, according to Vietnam Investment Review (VIR). A growth rate of approximately 5% per capita is needed for the country to reach this goal.

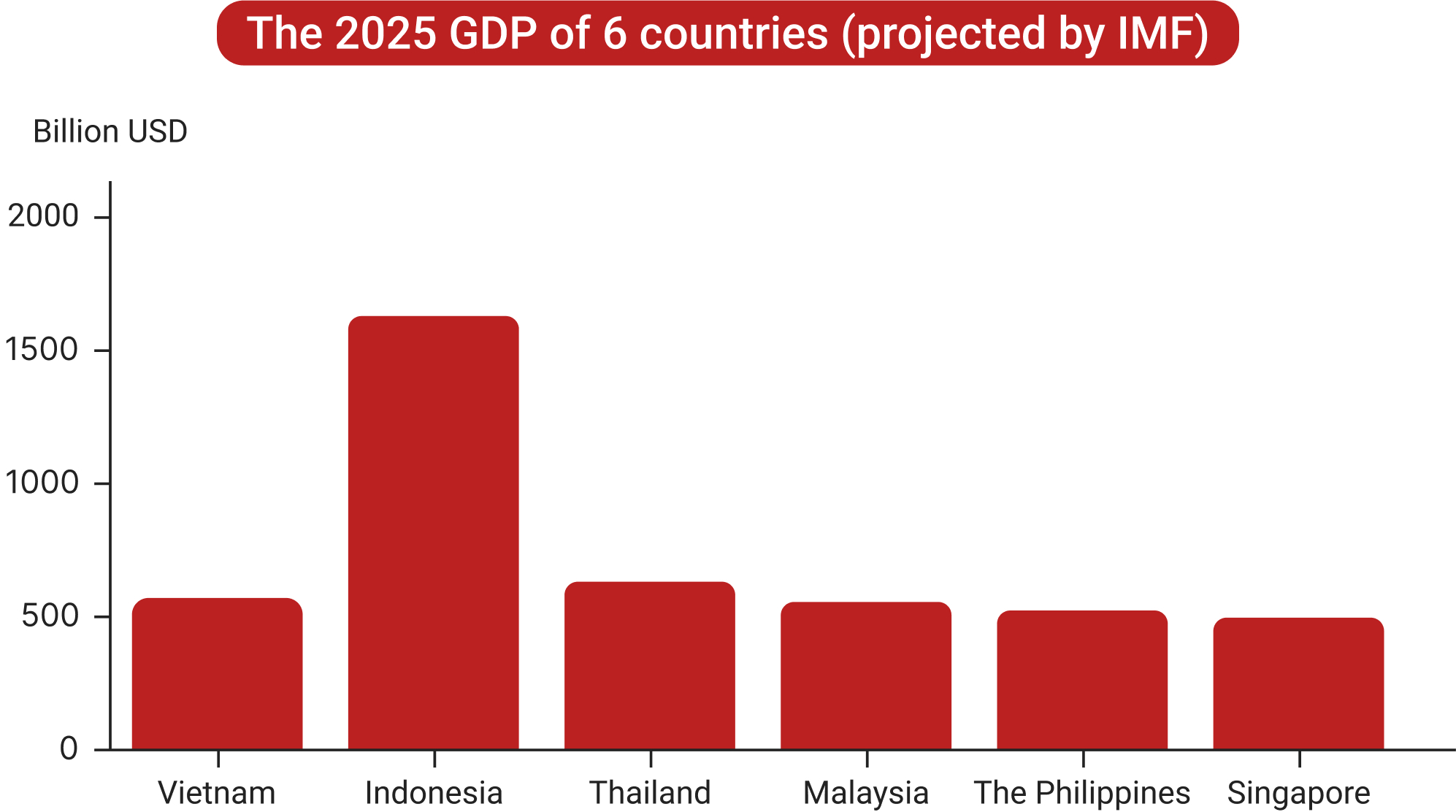

The International Monetary Fund (IMF) projected the 2025 GDP for the following countries as follows:

Apart from having the potential to surpass Thailand after 2028, Vietnam’s economy will outperform Belgium, Australia, Sweden, and Switzerland by 2036.

Digital Economy

The Department of Enterprise Management estimated that the country’s gross domestic product (GDP) could grow by USD 30 billion through the digitization of its small and medium-sized enterprises (SMEs). Here are some of the technologies that are changing the landscape of the digital economy in Vietnam:

Blockchain

As the number of blockchain tech apps rises and digital transformation accelerates, Vietnam will be able to compete on a global scale. There are projections that blockchain will create 40 million jobs by 2030, and 10-20% of the country’s business operations will be based on it.

As published by TechSci Research, it is expected that the industry will witness double-digit compound annual growth rates (CAGR). With the adoption of smart contracts and digital IDs across industries, the Vietnamese government is increasingly backing blockchain technology. Smart cities, e-commerce, and digital banking can all benefit from blockchain technology, especially when complemented with 5G infrastructure.

RELATED: What Foreign Investors Should Know about Vietnam’s Thriving Blockchain Technology Sector

Cloud Computing

The cloud computing business in Vietnam is expected to increase by almost 26% in the coming years, faster than anywhere else in Southeast Asia. The technology will improve security compared to physical servers, which will further boost productivity and reduce infrastructure and machinery costs.

Artificial Intelligence (AI)

Approximately two-thirds of businesses are integrating AI to enhance their digitization, as artificial intelligence will soon be able to operate and improve services and customer relations. Vietnam’s government is trying to establish the country as an innovation hub focused on artificial intelligence.

Internet of Things (IoT)

The percentage of companies that have started employing IoT has reached 86.67%, a 30% increase over 2021. Businesses have reported many benefits, including operating their gadgets remotely, gathering and managing data, taking action on them on demand, and sharing data.

5G and Broadband Networks

According to the Institute of Information and Communications Strategy, the 5G industry can generate about 7.34% of the country’s GDP by 2025. Telecom companies will use 5G to increase the adoption of AI and IoT in smart city development and business operations, including Virtual Reality (VR), Augmented Reality (AR), and HD videos.

According to the Ministry of Information and Communications Authority of Telecommunications, telecommunications networks are present in all provinces. As of now, 99.8% of the population has access to 2G, 3G, and 4G networks, while 16 provinces and cities have been testing 5G.

Moreover, in 2021, Vietnam had almost 71 million mobile broadband subscribers and 18.8 million fixed broadband subscribers.

About Us

InCorp Vietnam is a leading provider of global market entry services. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,100 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business perfectly fit into the market with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.